The rise of mobile technology has transformed numerous industries, and finance is no exception. Mobile banking apps have become a powerful tool, changing the way consumers manage their finances. These apps offer a wide range of features, making financial management more accessible, secure, and convenient than ever before. As more people rely on their smartphones for everyday tasks, mobile banking has become an essential service that continues to revolutionize personal finance.

Convenience at Your Fingertips

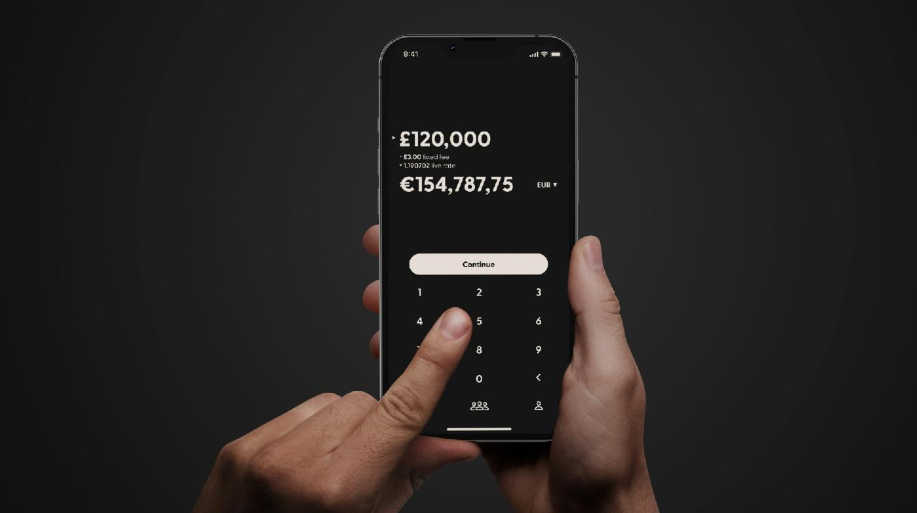

One of the biggest advantages of mobile banking apps is their convenience. Users can easily check account balances, view transaction history, and transfer funds—all from their smartphones. The need to visit a physical branch is eliminated, allowing users to bank anytime and anywhere. Real-time updates further enhance this convenience, keeping customers informed of their financial status instantly.

By allowing users to carry out transactions on the go, these apps save valuable time and effort, helping customers stay on top of their finances more efficiently.

Enhanced Security Features

Security is a top priority for mobile banking, and modern banking apps employ advanced technologies to protect sensitive financial information. Encryption is one such measure, ensuring that data like passwords, account numbers, and transaction details remain secure and inaccessible to cybercriminals. Encryption turns sensitive information into unreadable code, safeguarding it from unauthorized access.

In addition to encryption, many apps use biometric authentication—such as fingerprint recognition or facial scans—and two-factor authentication (2FA). These security features provide extra layers of protection by verifying the user's identity before granting access to the app. Together, they significantly reduce the risk of fraud, identity theft, or unauthorized transactions.

Expanded Financial Services

Mobile banking apps go beyond simple transactions; they offer a variety of financial services that make managing money easier. Many apps include tools for bill payments, savings, budgeting, and investments. For example, users can schedule automatic bill payments, track spending habits through categorized transactions, and even invest in stocks or mutual funds directly from their phones.

This expansion of services empowers users to handle multiple aspects of their financial lives from one platform. The ability to access these services in a single app creates a streamlined experience, making it easier for users to stay organized and achieve their financial goals.

Integrating Financial Services into Other Platforms

Some apps are combining financial services with other activities. One example is Vegasslotsonline UK, a gaming platform that has integrated a mobile banking system. This feature allows users to deposit and withdraw funds securely, demonstrating how financial services are merging with other industries to offer a seamless experience.

While the site is gaming-centric, it shows how apps can integrate secure mobile banking features to improve user satisfaction.

Impact on the Banking Industry

The rise of mobile banking apps has had a profound impact on the banking industry itself. Traditional banks have had to adapt to the increasing demand for mobile solutions, as younger generations prefer online and app-based banking over visiting physical branches. Many people now expect quick, accessible financial services that can be handled remotely, making mobile banking a vital component of the modern banking ecosystem.

The data generated by mobile banking apps also provides banks with valuable insights into customer preferences and behaviors. This information allows banks to personalize their services and develop new products tailored to individual needs. Personalization, made possible by user data, enhances customer satisfaction and strengthens relationships between banks and their clients.

Additionally, banks have benefited from cost savings due to reduced branch visits and staff needs. Mobile banking apps help financial institutions operate more efficiently, allowing them to allocate resources to other areas, such as digital innovation and customer service.

Challenges in Mobile Banking

Despite the benefits, mobile banking also faces challenges. One of the most significant concerns is the risk of fraud and cyber-attacks. Phishing scams, where cybercriminals trick users into giving away personal information, remain a common threat. Banks have implemented robust security measures, but users must also take steps to protect themselves. Awareness of potential risks and vigilance in recognizing suspicious activity are crucial to ensuring safe mobile banking experiences.

Another challenge is the digital divide. Not all consumers have access to smartphones, reliable internet connections, or the technical knowledge needed to use mobile banking apps. This is particularly true in rural areas or developing countries, where internet access may be limited. Financial institutions must find ways to bridge this gap and ensure that mobile banking services are available to a broader audience, including those who may not have the necessary technology.

The Future of Mobile Banking

As mentioned in Latinia , with advancing technology, mobile banking apps are expected to evolve even further. Artificial intelligence (AI) is likely to play a significant role in the future of mobile banking. AI-powered financial advisors could provide users with personalized advice on managing their finances, making investment decisions, and achieving savings goals. These AI systems will be able to analyze user data in real time, offering insights and recommendations that help users make informed financial decisions.

Blockchain technology is another area of innovation that could impact mobile banking. Blockchain’s decentralized nature offers enhanced security and transparency in financial transactions, reducing the risk of fraud or data manipulation. Banks are already exploring ways to incorporate blockchain technology into their mobile platforms, which could revolutionize how transactions are processed and recorded in the future.

Conclusion

Mobile banking apps have undeniably revolutionized the financial industry, offering users a convenient, secure, and accessible way to manage their finances. From simple transactions to advanced financial planning and investment tools, these apps empower individuals to take control of their financial lives. The continued development of mobile technology and the integration of AI and blockchain will only enhance these capabilities, positioning mobile banking as a cornerstone of personal finance in the future.

As banks continue to innovate, mobile banking apps will remain a crucial tool for consumers, providing a seamless blend of convenience and security. For users, the future of finance is increasingly within reach—right at their fingertips.

This article does not necessarily reflect the opinions of the editors or management of EconoTimes.

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge