Today October NFP report is to be published at 12:30 GMT from the US.

What is NFP report?

- NFP or non-farm payroll report is the monthly statistics on labour condition in the US released by US department of labour statistics. The report comprises goods, construction and manufacturing sector companies.

- This report influences the financial markets deeply across asset class.

Key highlights –

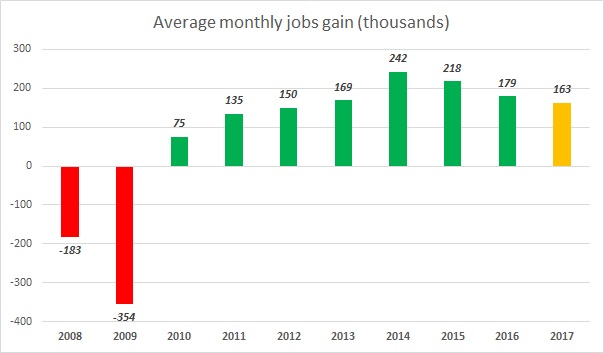

- The headline number for total hires last month was -33,000. October ADP employment number was very encouraging at 235,000 after September’s discouraging 135,000.

- Today payrolls are expected at 310,000.

- The second most vital component is wage growth which as of now is showing healthy growth of 2.9 percent. Today expected at 2.7 percent y/y.

- The labour force participation rate is showing no signs of rebound. However, it was up 0.2 percent to 63.1 percent, in the last report.

- The unemployment rate is expected to remain same at 4.2 percent.

- The underemployment rate is expected to improve further from current 8.3 percent.

- Average weekly hours were previous 34.4; No major change is expected.

Impact –

- The immediate impact is usually very volatile and today could be more as the market is already agitated by weak economic dockets coming out of the United States.

- A strong report especially the headline number (above 300,000) and wage growth could lead to a rise in the dollar which has been struggling this week.

- Dollar selloffs could accelerate on a materially weak report of headline below 200,000. The dollar index is currently trading at 94.7, up 0.07 percent so far today.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions