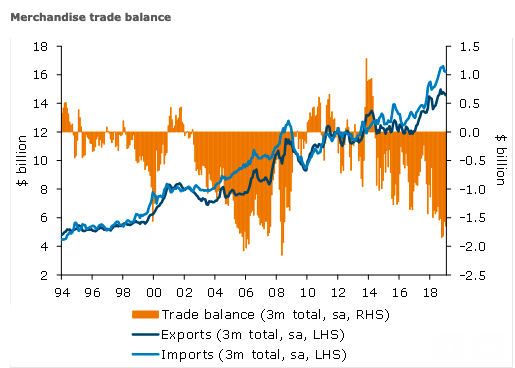

New Zealand’s trade balance for the month of January came in considerably weaker than market expectations with exports below expectations and imports considerably stronger. Exports are expected to pick up in the coming months as more meat and dairy products start to flow out of the country, according to the latest report from ANZ Research.

The unadjusted monthly trade balance turned a large deficit of $914 million in January. Exports at just $4.4 billion were below expectations with the slow start to the meat processing season primarily to blame. Imports were strong, partially due to a $200 million large item, but the overall import strength indicates domestic demand remains robust.

On a seasonally adjusted basis, exports decreased 7.8 percent m/m. Dairy volumes lifted, but the recent uptick in dairy prices is yet to be reflected in export values. Meat volumes were down 6.2 percent which combined with slightly weaker prices pulled the value of this export category down 8.8 percent. Strong prices for logs offset a sharp reduction January export volumes which were down 25.3 percent.

Seasonally adjusted imports rose 0.4 percent m/m. Petrol imports dropped by 6.1 percent following a strong lift the previous month. Textiles imports lifted 29.3 percent, more than offsetting the sharp drop in December. Imports of optical and medical goods lifted sharply, up 16.7 percent m/m in January. There was also a large item ($200 million) boosting an already robust print for monthly imports.

On a regional basis, exports to China maintained their positive trend, up 15.2 percent in the year to January. However a sharp drop in exports to Australia was recorded in January, although on an annual basis exports to this market are still slightly stronger.

"The annual deficit is expected to narrow as the year progresses reflecting stronger export volumes of meat, dairy and forestry, while the improvement in prices for dairy should start to flow through in the coming months," the report added.

Image courtesy: ANZ Research

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility