The New Zealand economy is expected to have expanded 0.5 percent q/q in Q3, reflecting a touch of payback from Q2’s strong 1.0 percent q/q print, but with the deceleration limited by stable underlying momentum, according to the latest report from ANZ Research.

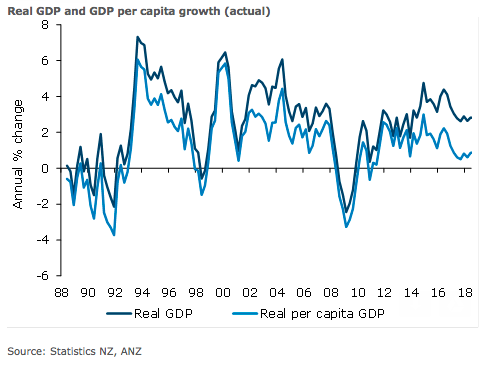

This would see annual growth moderate to 2.7 percent in Q3 from 2.8 percent, within recent ranges and consistent with expectations that growth will remain range bound at 2-1/2-3 percent over the next couple of years.

The seasonally adjusted current account deficit is expected to narrow in the quarter, but widen in annual terms to 3.6 percent of GDP on base effects.

More broadly, migration-led population growth has been flattering headline growth this entire cycle, contributing around two thirds of the economic expansion in recent years. And while this is set to provide a boost for a while yet, easing net inflows imply a shrinking impetus to growth going forward.

A 0.6 percent q/q rise in services industries is expected to make the largest contribution to quarterly growth: 0.4 percentage point, led by wholesale trade (up 1.2 percent q/q) and arts and recreation (up 3.0 percent q/q).

"Broadly speaking, we suspect ongoing strength in population growth will continue to make its presence known on the services side, with small quarterly gains across most components. In fact, the only source of significant weakness among the services components is expected to come from accommodation, which appears set to retrace Q2’s solid rise," the report commented.

Goods production is next on the list, and expected to rise 0.6 percent q/q, making a 0.1 percentage point contribution to quarterly growth. A 1.0 percent q/q lift in construction is at the fore here, while both food (up 0.1 percent q/q) and ex-food manufacturing (up 0.3 percent q/q) look set to record modest rises.

Meanwhile, the seasonally adjusted Balance of Payments deficit is expected to narrow around USD0.4 billion from Q2, driven by a narrowing goods deficit as growth in exports outpaces that of imports. The 0.3 percent fall in the Q3 OTI terms of trade suggests this will be entirely volume driven.

The services surplus is expected to narrow a touch as seasonally adjusted exports partially retrace some of Q2’s strength and imports lift. The income deficit is expected to widen, with primary income outflows lifting on the back of growing international debt and equity liabilities. The annual current account deficit is expected to widen 0.3 percentage point of GDP to 3.6 percent, owing to base effects, ANZ Research added in its report.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence