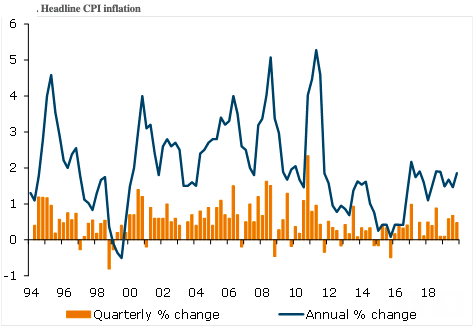

New Zealand’s consumer price inflation (CPI) lifted 0.5 percent q/q in Q4 – in line with ANZ forecasts, but stronger than the market (0.4 percent) and the Reserve Bank of New Zealand’s (RBNZ) November MPS forecast (0.2 percent).

At 1.9 percent, annual inflation is running just 0.1 percentage points shy of the 2 percent target midpoint, but with non-tradeable inflation expected to remain close to 3 percent y/y and a lift in tradeable inflation in the pipeline, 2020 should bring a 2-handle.

The surprise versus the RBNZ’s forecast comes from stronger-than-expected tradeable inflation. This is the more volatile and less persistent type of inflation, given it is heavily influenced by exchange rate movements and global supply and demand dynamics, ANZ Research reported.

Tradable inflation lifted 0.4 percent q/q (RBNZ: -0.2 percent q/q), reflecting recent NZD weakness. The lift is stronger than is typical for a December quarter. A smaller seasonal dip in fruit and vegetable prices contributed.

Non-tradable (domestic) inflation rose 0.6 percent q/q, with housing-related costs (rents and the purchase of housing) remaining a persistent driver. With the housing market picking up, this theme looks set to continue for a while yet.

Annual headline inflation lifted to 1.9 percent from 1.5 percent in Q3, with non-tradable inflation dipping 0.1 percentage point from Q3 to 3.1 percent y/y and tradable inflation lifting to 0.1 percent y/y from -0.7 percent y/y.

"Looking forward, we think economic activity is poised to gradually accelerate over the year ahead and grow around trend over the medium term, with resurgence in the housing market, improving business sentiment and the promise of a little extra government spending on key infrastructure all supporting. Unless something untoward happens, we think the RBNZ will keep the OCR at its current, stimulatory, level of 1 percent for the foreseeable future," ANZ Research further commented in the report.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal