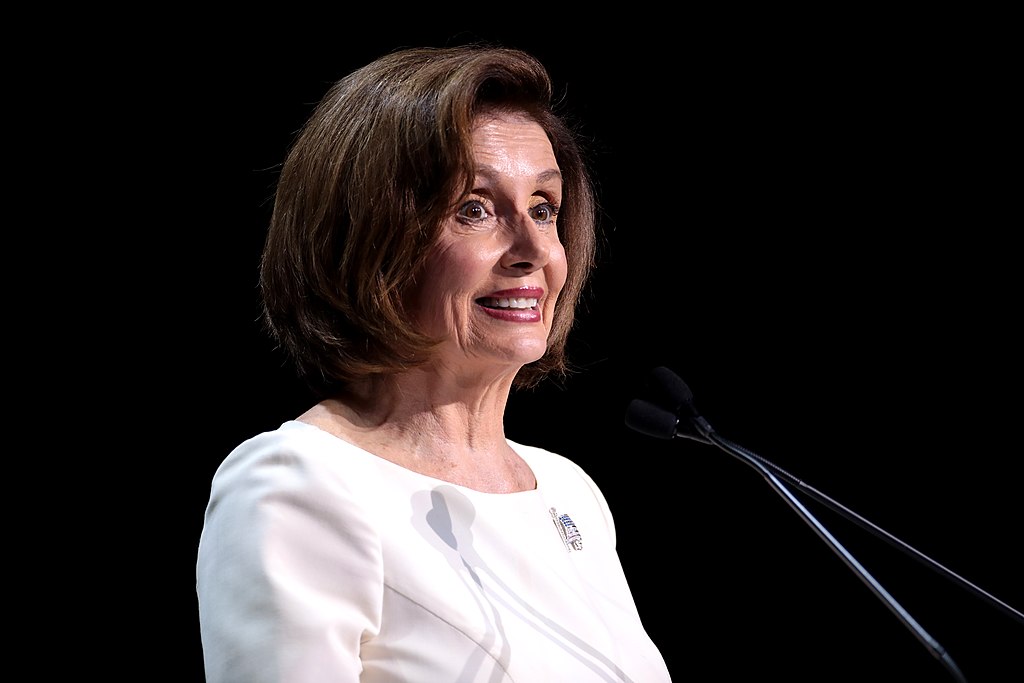

Former House Speaker Nancy Pelosi, representing California’s 11th congressional district, made significant stock trades between mid-December and mid-January, according to a Periodic Transaction Report. Pelosi sold 31,600 shares of Apple Inc. (NASDAQ: AAPL) for $5 million to $25 million on December 29, 2024. This marks her largest trade in the past month.

On January 14, 2025, Pelosi purchased 50 call options in Alphabet Inc. (NASDAQ: GOOGL) and Amazon.com Inc. (NASDAQ: AMZN) with a strike price of $150 and an expiration date of January 2026. Both trades were valued between $250,001 and $500,000. Additionally, Pelosi sold 10,000 shares of NVIDIA Corporation (NASDAQ: NVDA) for $1 million to $5 million and exercised 500 call options in the company worth $500,001 to $1 million. She also bought 50 call options in Nvidia, striking at $80 and expiring in January 2026.

Other notable trades include exercising 140 call options in Palo Alto Networks Inc. (NASDAQ: PANW) worth $1 million to $5 million and purchasing 50 call options in Tempus AI Inc. (NASDAQ: TEM) and Vistra Energy Corp. (NYSE: VST).

Critics often point to Pelosi’s trades, arguing her role as a lawmaker provides her with an unfair advantage. A 2012 law mandates Congressional members disclose trades within 45 days to prevent insider trading.

Data from Unusual Whales shows Pelosi’s portfolio surged 70.9% in 2024, outperforming the S&P 500's 25% rise. However, Rep. David Rouzer of North Carolina led Congress with a 140% portfolio gain. ETFs tracking Congressional trades, like NANC and KRUZ, also draw attention to such activities.

This activity underscores ongoing debates around ethics and stock trading in Congress.

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans