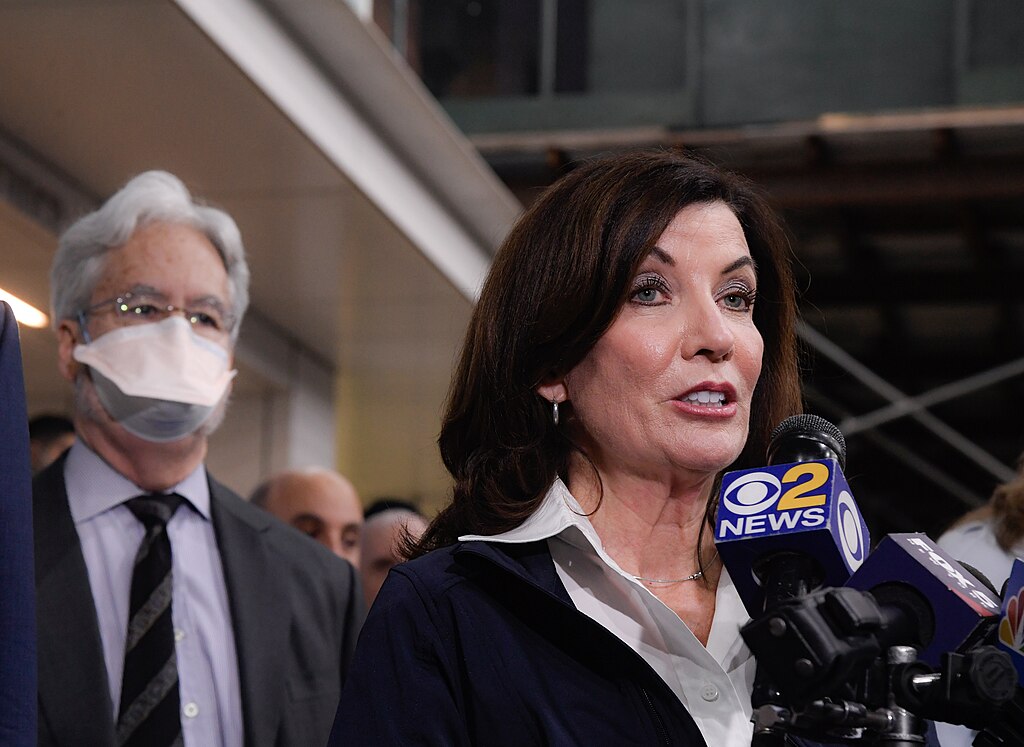

New York Governor Kathy Hochul is evaluating whether to raise corporate taxes as the state prepares for a significant budget shortfall driven in part by expected federal funding cuts, according to a source familiar with the discussions. While no final decision has been made, officials say the state’s fiscal outlook early next year will depend heavily on federal actions under the new administration.

The potential tax hike comes as New York faces a projected $34.3 billion deficit through fiscal year 2029. Although the state comptroller warned that the combined impact of the deficit and recent federal changes has pushed New York into its most challenging financial position since the 2009 economic crisis, state budget director Blake Washington insisted recently that New York remains “in a good spot financially,” adding that raising taxes is “the last thing on my mind.”

Mayor-elect Zohran Mamdani, who campaigned on affordability issues, has publicly called for increasing the state’s top corporate tax rate from 7.25% to 11.5%. His platform also includes freezing rent and imposing higher taxes on the wealthy. Mamdani’s team did not respond to requests for comment.

Tensions between state and federal leaders are adding uncertainty. President Donald Trump, who endorsed former Governor Andrew Cuomo in the mayoral race, has stated he is unlikely to provide substantial federal funds to New York City, pledging only the “minimum required” under law following Mamdani’s victory.

During a 90-minute meeting on Thursday, Hochul and Mamdani discussed the state’s finances as well as concerns over potential federal actions, including the possibility of ICE or National Guard deployments to New York City. According to a meeting readout, both leaders agreed that such a federal surge would not improve public safety. State officials also briefed the mayor-elect on preparedness plans should New York become a federal target.

The governor’s office emphasized that the state remains vigilant as it monitors federal decisions and explores strategies to safeguard New Yorkers during a period of growing political and fiscal uncertainty.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election