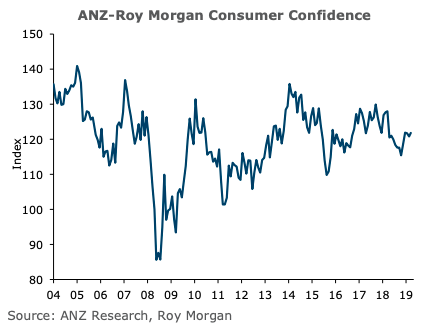

New Zealand’s ANZ-Roy Morgan consumer confidence rose 1 point in March and sits around average levels. Perceptions of current conditions fell 1 point, while the future conditions index rose 2 points. The proportion of households who thinks it’s a good time to buy a major household item fell 1 point.

Consumers’ perceptions of their current financial situation fell 2 points to a net 12 percent feeling financially better off than a year ago. A net 29 percent of consumers expect to be better off financially this time next year, up 2 points.

A net 38 percent think it’s a good time to buy a major household item, down 1 point. Perceptions regarding the next year’s economic outlook rose 1 point to a net 10 percent expecting conditions to improve. The five-year outlook rose 6 points to +21 percent.

By region, Auckland lifted the most, to a 1-year high (up 4 points to 124), but Canterbury and the rest of the South Island were the least confident regions at 121 and 115, respectively.

House price inflation expectations were unchanged at 2.7 percent. They remain weakest in Auckland (1.9 percent). Inflation expectations lifted 0.3 percentage points to 3.7 percent.

Overall, consumer confidence remains buoyed around its historical average despite mounting global and domestic risks. Confidence has picked up from 2018 lows, but caution regarding the overall economic outlook appears to be preventing a break above average levels.

However, a high proportion of people thinking it’s a good time to buy a major household item suggest robust household spending despite weakness in Auckland house prices and slower housing market activity.

"We see economic growth averaging around 2-1/2 percent over the next couple of years, with slower population growth and weaker housing wealth effects weighing on consumption growth," ANZ Research commented in its latest report.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices