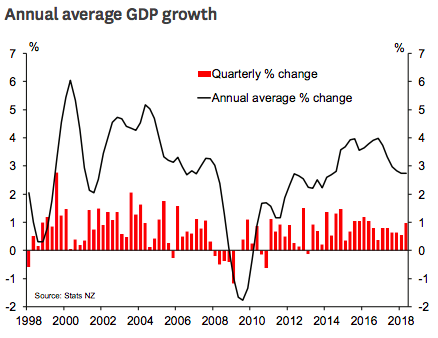

The New Zealand economy fared substantially better in the June quarter, with a 1 percent rise in GDP following gains of 0.5- 0.6 percent in each of the previous three quarters. Growth is still some way off the peaks seen in 2015-16, when the economy regularly grew by 1 percent or more each quarter.

But the latest figures will help to soothe any concerns that the economy is heading into a slump. The June quarter result was ahead of the median market forecast of 0.8 percent growth, and even beat Westpac’s 0.9 percent forecast which was at the upper end of the range.

The Reserve Bank had forecast a rise of just 0.5 percent for the quarter, and commented that if it didn’t see an acceleration in growth then it would need to consider cutting the OCR. Financial markets took those comments to heart, and speculation about rate cuts has been mounting in recent weeks ahead of next Thursday’s OCR review, according to the latest report from Westpac Research.

Expenditure GDP rose by 1.2 percent in June quarter, following a weak 0.4 percent rise in the March quarter. Household spending rose by 1 percent, rebounding after a flat result in March. As noted earlier, government expenditure rose strongly, and residential and non-residential building were up slightly. Exports of both goods and services saw strong gains.

"One possible note of caution from the expenditure figures is that investment in plant and machinery was down by 1.3 percent for the quarter. This is one area where weak business confidence could have real consequences for the economy. For now it looks more like business investment has plateaued at a high level – there was a sharp lift in investment in the December quarter last year that hasn’t been unwound yet. Nevertheless, this is an area that we’ll be keeping an eye on," the report added.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility