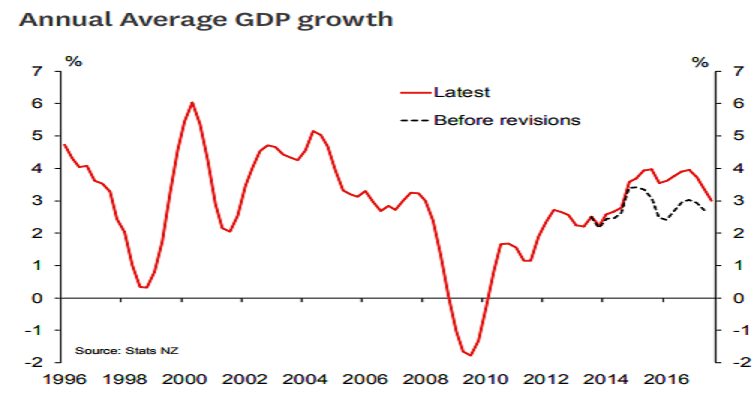

New Zealand’s gross domestic product (GDP) for the third quarter of this year beat market expectations, although in line with the median market forecast. GDP rose 0.6 percent in the September quarter and was also revised up in each of the two previous quarters of this year.

Construction made the biggest contribution to growth in the September quarter. Output rose by 3.6 percent, reversing the decline seen over the first half of this year that may have been due to wet weather delaying activity.

There were also surprisingly strong gains in transport (+1.4 percent) and mining (+3.2 percent). Agricultural output was about flat, as a drop in milk production was offset by gains in cattle farming. Retail spending was up, but accommodation and hospitality were down, as tourist numbers dropped back after the Lions rugby tour in June. Electricity demand was down due to a warmer than usual winter and spring.

"Our view remains that the September quarter will mark the low point for growth in 2017. Many of the factors that held back growth – in dairying, tourism and electricity generation – were temporary, and the indicators to date for the December quarter have been significantly stronger," Westpac Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility