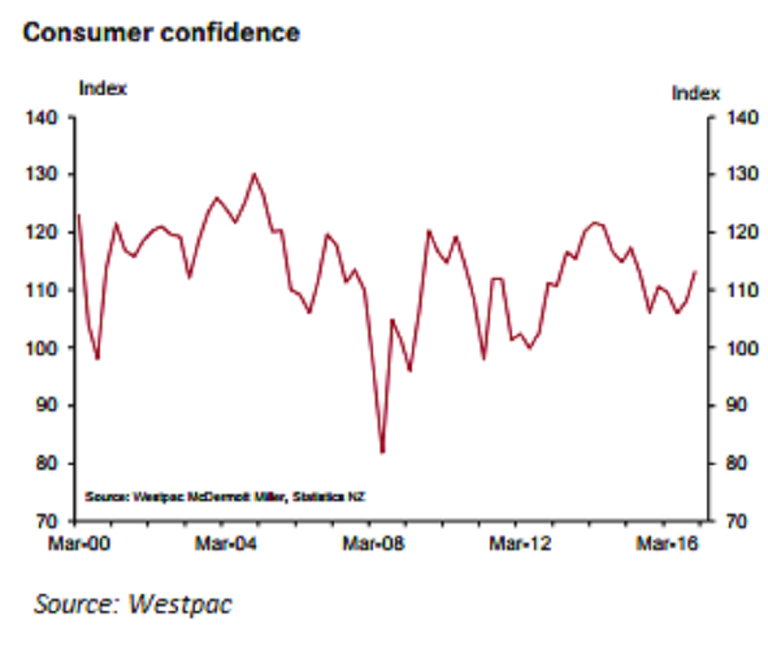

Consumer confidence in New Zealand jumped during the last quarter of this year, following optimism over the prevailing festive season, adding to shopping mood among the consumers. Also, expectations of an upbeat economic growth, yet to be released later this week added to the bright outlook.

The Westpac McDermott Miller Consumer Confidence survey showed that household confidence rose by a solid 5.2 points in the December quarter - its largest increase in four years. That follows a modest increase last quarter, and leaves confidence sitting a little above its long-run average.

The pick-up in confidence comes on the back of an economy that is humming along. Growth figures due later this week are expected to show the economy expanded by a healthy 3.6 percent over the past year, supported by low-interest rates, a large pipeline line of construction work, rapid population growth and strong tourist inflows.

Importantly, this strength in economic conditions has been passing through to an improving labor market, with the number of full-time equivalent employees up 3.3 percent over the past year. Confidence is up in most parts of the economy. Notably, there was a sizeable gain in confidence among rural households, building on last quarter’s solid gain. This improvement follows a dramatic turnaround in the fortunes of the dairying sector.

Export prices for dairy products have surged in recent months. As a result, cash flows for most farmers will be headed back into the black over the coming year.

"However, we don’t expect to see a big rebound in farm-related investment and spending just yet. Many farmers will have taken on additional debt in recent years to carry them through the period of low prices, and this will need to be repaid," Westpac commented in its latest research note.

Further, there has also been a strong rise in confidence among those households earning less than $50,000 a year. Many of these households reported that they are now more optimistic about where the economy is headed. This is likely to reflect the strengthening of the labor market, which will hold on for some time.

Meanwhile, NZD/USD traded at 0.70, up 0.36 percent, while at 5:00GMT, the FxWirePro's Hourly NZD Strength Index remained highly bearish at -129.87 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom