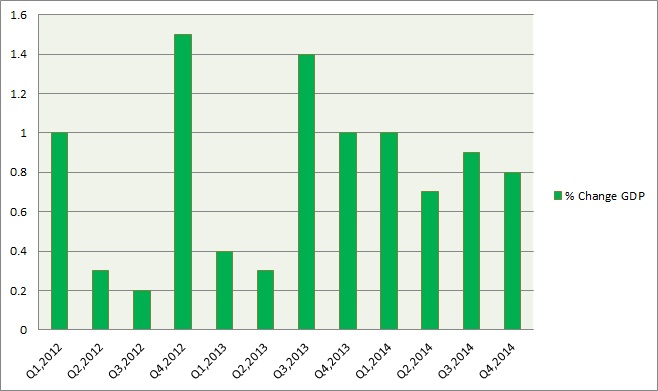

New Zealand's GDP figure published for the quarter, grew at a solid pace. Since underlying growth dynamics remain robust, RBNZ may once again start off the hiking cycle or at least keep the rates on hold for now. Only concern is inflationary pressure remains weak.

Details -

- Size of the economy is $240 billion for fourth quarter among which $135 billion was contributed by household spending, $70 billion from export, $65 billion from import, $55 billion from investments and rest from government.

- Economic activity grew 0.8% QoQ and 3.5% YoY. Growth improved on a yearly basis however lagged previous quarter.

- Retail trade and accommodation up 2.3 percent, rental, hiring, and real estate services up 1.2 percent, financial and insurance services up 1.1 percent.

- In spite of strong New Zealand dollar, exports of goods and services increased by 6.1%

- Domestic consumption remained strong growing 0.6%. Investments grew on durables.

Impact -

- New Zealand is expected to have higher interest rate outlook. If inflation concern subside with a rebound in commodity prices like whole milk powder economy will be better positioned to handle rate increase.

- New Zealand stock market is expected to do well along with New Zealand dollar. Kiwi is currently trading at 0.742.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings