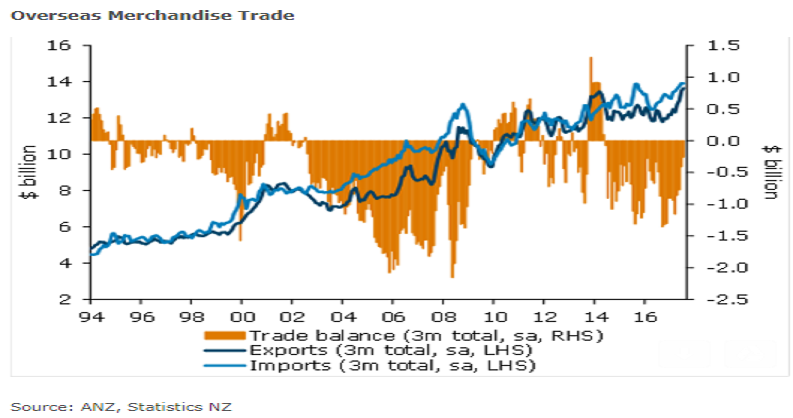

New Zealand’s trade surplus of NZD85 million was only the 11th surplus for a July month since 1960. It was the first July surplus since 2012. There was a strong export performance driven yet again by China, with exports 51 percent higher than last year. Broader Asian exports were also robust. Dairy led the charge, but there were also strong performances from meat, forestry, and horticulture.

This reflects the broad-based pick-up in New Zealand primary sector prices since early 2016. Import values remained fairly steady with manufacturers perhaps undertaking some restocking and no let-up in the vehicle and associated part imports. The unadjusted trade surplus of $85m was stronger than expectations of an NZD200 million deficit. In seasonally adjusted terms the July surplus of NZD154 million was the strongest result since August 2014 when dairy was booming.

Export values rose a massive 16.8 percent y/y. By country, China was at the epicenter, with exports up 51 percent y/y. There was also support from other Asian countries, such as Japan, South Korea, Malaysia, Thailand, Indonesia, Philippines and Vietnam where short-term momentum is generally of the double digit variety.

In contrast, import values rose 5.4 percent y/y. Intermediate goods imports (+14.5 percent y/y) remained robust, reflecting a more buoyant global manufacturing backdrop and local construction/infrastructure activity. Recent currency strength is also arguably providing a restocking opportunity.

"There are a few technicalities to note, but overall we see the data as consistent with our view that net exports should unwind some of their recent drag on GDP growth," ANZ Research reported in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal