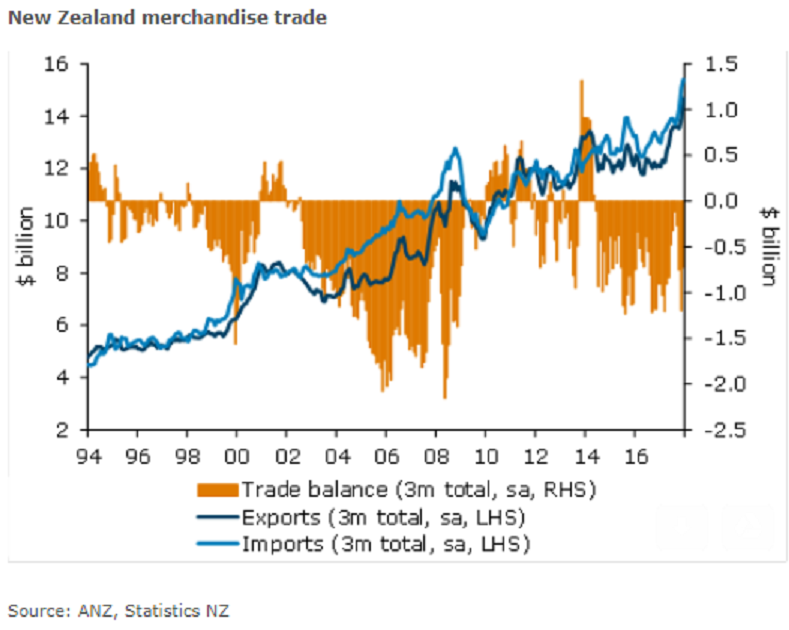

New Zealand’s solid export performance boosted the overall trade balance in December. In many ways that reflect the strong export commodity price backdrop and positive global demand picture overall, and is a theme that should continue to underpin the figures for a while yet.

That said, the December performance will have been impacted by timing issues surrounding the earlier dry weather and Chinese demand for the free-trade window. Some of that strength will unwind over the coming months.

An unadjusted trade surplus of NZD640 million was seen in December, which was well above market expectations. In fact, we believe it is the first surplus for a December month since 2013. It follows a large NZD1.2 billion deficit in November, which in part was impacted by a large one-off import. In seasonally adjusted terms, a monthly surplus of NZD230 million was seen, which is the largest in nearly three years.

Seasonally adjusted export values surged 13 percent m/m. Dairy and meat exports led the way (up 9.1 percent m/m and 7.6 percent m/m respectively), although the majority of export categories rose solidly, reflecting the decent global growth picture and elevated level of NZ’s export commodity prices. Demand from China was strong, which for dairy is likely to reflect demand for the free-trade window. However, this (and meat export strength) could unwind somewhat in early 2018 as dry conditions hampered production growth.

After a strong run, import values fell 4.5 m/m in seasonally adjusted terms. Falls were relatively broad-based, but again within the context of strong growth over the prior months. The drop was also impacted by a 22 percent m/m fall in petroleum imports, which are highly volatile and irregular.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices