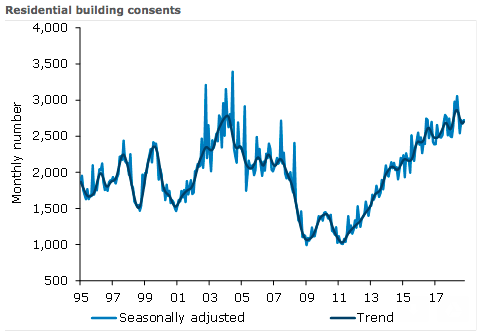

New Zealand’s residential consents increased 1.5 percent m/m in October, after finishing Q3 on the softer side. Strong growth in consented floor area bodes well for residential investment into the start of 2019.

But further growth will be needed in coming months to see activity levels maintained if not increase. Building activity is at a high level, but the construction industry is facing challenges and capacity constraints are acute.

Annual consent issuance remains very elevated; a little over 32,700 new dwelling consents were issued over the past year. However, capacity constraints are acute, and issuance has struggled to push higher over the past six months – remaining shy of highs reached in the mid-2000s (of more than 33,000 dwellings).

Generally speaking, housing demand remains strong and supportive of further building work. Population growth is still solid and has outpaced supply, while interest rates are generally low.

Nonetheless, the construction industry is facing challenges of rising costs, labour shortages and delays, which may limit the scope for activity to go higher. And although Kiwibuild will support demand in coming years, it is unlikely to boost activity significantly, due to crowding out of private sector activity in the face of capacity constraints.

Non-residential consented floor area ticked up 3 percent m/m in October, but this follows recent softening. Non-residential consents are showing tentative signs of stabilisation, which is positive in light of firms’ apparent pessimism.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains