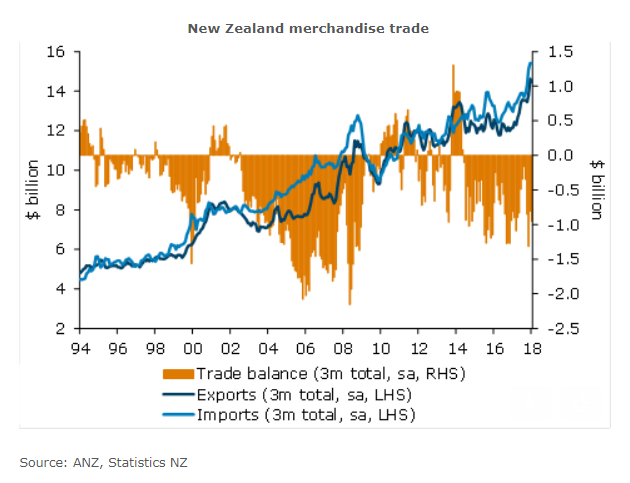

New Zealand trade balance data surprised markets, unexpectedly showed the biggest January trade deficit since 2007. Statistics New Zealand earlier today reported a trade deficit of NZD 566 million, wider than the NZD 227 million deficit in January last year and the largest for the month since 2007. The deficit contrasts with previous month's NZD 596 million surplus, which was the largest ever for a December month.

Details of the report showed exports rose 9.5 percent to $4.3 billion compared with the same period a year ago, led by a rise in the volumes in milk powder, butter, and cheese. Higher dollar, lower commodity prices for dairy and meat, and lower volumes of fruit such as apples and kiwifruit due to the weather all weighed on exports. While on the other side, imports surged 17 percent to $4.9 billion, with increases across a range of commodities including turbo-jets, diesel and ships. Both exports and imports hit new highs for January month.

Economists at ASB Bank said they expected that some of the weakness in the trade data was temporary and the annual deficit will narrow over the course of the year.

The kiwi was dampened as a result of the data. NZD/USD was trading 0.32 percent lower on the day at around 0.7278 at 1200 GMT. NZD/JPY also ran into fresh offers on a dismal New Zealand trade balance report. The pair is down 0.24 percent on the day and was hovering around 77.86 levels.

"After a very strong end to 2017 there was a pullback in January exports across all the main sectors. The pace of imports remained brisk too with strength across most categories. This indicates the domestic economy has started 2018 in reasonable shape," said ANZ Research in a report.

NZD/USD finds strong trendline support at 0.7275. Break below to see further weakness. Technical studies have turned bearish. RSI and Stochs are biased lower. Violation at 0.7275 (trendline) could see test of cloud top at 0.7185. NZD/JPY remains capped below 5-DMA and momentum is bearish. The pair eyes 78.6% Fibo at 77.26.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand