New Zealand’s unemployment rate rose back to 4.2 percent in the third quarter of the year. This was in line with ANZ expectations, but slightly higher than the market expected. The 4.2 percent print reflected a bounce-back from 3.9 percent, which was the lowest unemployment rate in 11 years, and takes us back to where we were at the start of the year.

The details of the release were mixed – employment rose a soft 0.2 percent in the quarter. But wages were robust and a broader measure of labour market tightness did strengthen; the underutilisation rate ticked down to 10.4 percent from 11.0 percent last quarter.

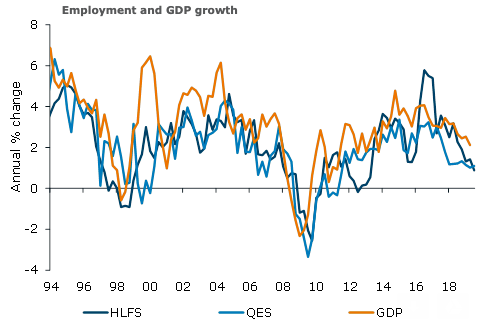

Employment growth in Q3 was weak, following solid growth the previous quarter. Growth in HLFS employment (a survey of households) was up 0.2 percent q/q. Annual employment growth dropped to 0.9 percent y/y from 1.4 percent, consistent with the weakness seen in job ads and surveyed hiring intentions. The participation rate ticked up slightly to 70.4 percent, close to its historically high level.

Wage inflation was robust, in line with expectations, but remains relatively subdued outside of regulated wage increases and collective agreements. The private sector Labour Cost Index increased 0.6 percent q/q, in line with market expectations. Annual growth ticked up to 2.3 percent, but excluding minimum wage increases is up only 1.9 percent y/y.

This labour market data will be incorporated into the RBNZ’s forecasts in the MPS next Wednesday, but is unlikely to have a material impact. In the August MPS, the RBNZ forecast an unemployment rate of 4.4 percent in Q3 anyway, prior to the drop in unemployment to 3.9 percent in the Q2 release.

An unemployment rate of 4.2 percent still indicates a ‘tight’ labour market, but it shouldn’t be forgotten that the RBNZ now has an employment mandate and the outlook for the labour market is looking cloudier.

The labour market lags economic activity, domestic growth doesn’t look like it is going to recover sharply from here, and businesses’ hiring intentions are low.

"We expect that below-trend economic growth will see the unemployment rate move up a little further over the next year, peaking around 4.5 percent, before a gradual recovery in GDP growth helps push it lower again," the report further commented.

"Although it isn’t the ‘lock’ it was, on balance we expect the RBNZ to cut the OCR 25bps next week at the November MPS and signal that further cuts remain a possibility should the dataflow and outlook warrant – we expect it will, in time. We continue to expect further rate cuts in February and May next year, aimed at preventing inflation and inflation expectations from slipping further. This would take the OCR to a new record low of 0.25 percent," ANZ Research added in its comments.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility