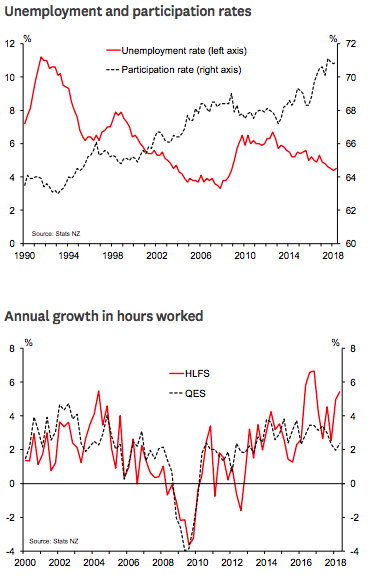

Labour market conditions were generally firmer in the June quarter. Jobs growth was robust, though the unemployment rate ticked up slightly. With the economy moving closer to full capacity, the first signs of a stirring in wage growth are finally emerging.

While the results were stronger than what was expected, they were largely in line with the Reserve Bank of New Zealand’s (RBNZ) forecasts in its May Monetary Policy Statement. The only aspect that fell short was the rise in the unemployment rate, and that was well within the margin of error for this survey.

"We think the RBNZ will be satisfied with both its contribution to “supporting maximum sustainable employment” – as specified in its new dual mandate – and with the evidence that inflation pressures are gradually picking up as intended," Westpac Research commented in its latest report.

Meanwhile, the labour market figures are perhaps best seen as a corrective to the pessimism seen in recent business confidence surveys. Growth in activity has slowed from its peak, but businesses have remained open to hiring. And while wage growth has picked up, it’s not spiralling higher in the way that businesses seem to fear.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices