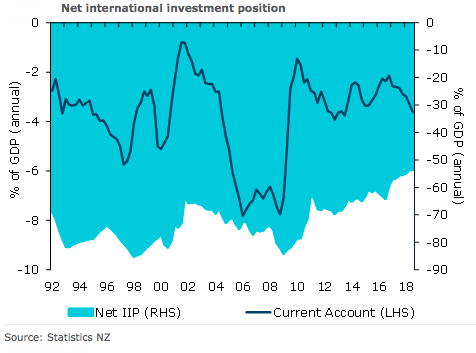

New Zealand’s Q3 balance of payments data was much as expected. Seasonal factors drove a quarterly deficit, but seasonally adjusted a narrowing goods and income deficit was offset by a smaller services surplus. The annual current account balance widened a touch from 3.3 percent to 3.6 percent of GDP.

The unadjusted quarterly current account balance pushed deeper into deficit in Q3 (from $1.6bn in Q2 to $6.1bn), as it always does in Q3. The goods balance slipped into deficit as exports fell (mirroring seasonal agricultural production) and imports began their seasonal lift (which generally peaks in Q4).

The unadjusted services balance dipped into deficit territory (-$0.3bn), with imports up $0.5bn (reflecting the usual pickup in kiwis going on overseas holidays to escape winter) and exports down $0.7bn (reflecting the seasonal lull in inbound tourists). A narrowing quarterly income deficit (from $2.7bn to $2.6bn) provided some offset.

The annual deficit widened to $10.5bn from $9.5bn in Q2, which saw the current account as a share of GDP tick up 0.3 percentage point to 3.6 percent. This brings the annual deficit in line with its historical average of 3.6 percent of GDP.

In seasonally adjusted terms, the quarterly current account deficit narrowed by $0.1bn to $2.6bn. As expected, this was driven by a narrowing goods deficit (by $0.3bn to -$1.0bn), with a narrowing income deficit also lending a hand. A narrowing seasonally adjusted services surplus (by $0.3bn to $1.1bn) provided an offset.

"Overall, ongoing broad-based strength across other primary sector exports is expected to drive a slight narrowing in the annual goods deficit over the year ahead, but solid imports growth (on the back of continued population-led growth in domestic demand), will keep the balance in check. Likewise, the services surplus is expected to remain buoyed by solid tourist spending, but with services imports growth broadly keeping pace and the balance contained. Rising primary income outflows are expected to drive a gradual widening in the income deficit as rising global interest rates see international debt servicing costs lift," ANZ Research commented in its latest report.

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target