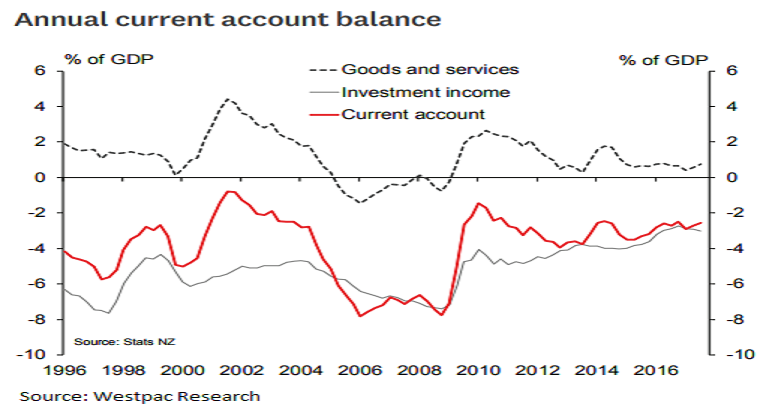

New Zealand’s annual current deficit is expected to narrow further, with dairy export prices and volumes both stronger than they were a year earlier. However, a recent surge in imports (see below) challenges our view on how far the deficit will narrow.

The country’s current account deficit narrowed slightly to 2.6 percent of GDP in the year to September. That compares to a deficit of 2.7 percent in the year to June (revised from 2.8 percent, thanks to upward revisions to nominal GDP). The deficit was larger than we expected, due to higher imports and lower earnings from overseas investments.

In seasonally adjusted terms, the goods trade deficit narrowed to NZD26 million, the smallest deficit in three years. Exports were fairly steady in the September quarter, while imports fell, though not as much as we expected. The surprise was due to conceptual adjustments (such as the timing of changes of ownership), which is not a persistent factor.

The surplus on services trade narrowed to NZD1,186 million in September. However, it didn't fully unwind the jump in tourism earnings in the June quarter, which was boosted by the Lions rugby tour.

The investment income deficit widened to NZD2,384 million in September, compared to NZD2,072 million in June. Earnings from New Zealanders' investments abroad fell by more than we expected. Investment income outflows also fell slightly.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal