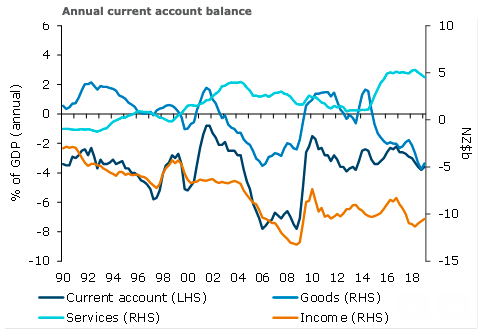

New Zealand’s annual current account deficit narrowed $0.6 billion from an upwardly revised Q4 to $10.6 billion in Q1. This saw the current account deficit as a share of GDP narrow from 3.8 percent to 3.6 percent, which is in line with its historical average.

As is typically the case, the unadjusted quarterly current account transitioned from deficit in Q4 to surplus in Q1 (from -$3.5 billion to $0.7 billion). This was slightly larger than the $0.2 billion surplus we had pencilled in. Much of the variance seems timing related, with revisions appearing to capture a large chunk.

The goods deficit flipped into surplus, reflecting an unwinding in seasonal import demand over the summer months and as exports remained robust on the back of still-high prices and solid agricultural production in recent quarters.

While the OTI terms of trade suggest goods export prices did indeed fall in Q1, this was by less than the decline in import prices, with the net impact on the trade balance being positive.

The unadjusted services surplus widened from $1.0 billion in Q4 to $3.0 billion in Q1 as imports dipped (fewer kiwis go on overseas holidays when the weather back home is good) and exports lifted, reflecting the usual seasonal peak international tourism demand.

In seasonally adjusted terms, the current account deficit was broadly stable in Q1, narrowing by just $60 million. A smaller goods deficit (on slightly softer imports) was offset by a smaller services surplus, which shrank by around $0.1 billion on the back of higher services imports.

As expected, New Zealand’s net international liability position (NILP) improved (by $4.0 billion to $164.4 billion), largely reflecting a rebound in the value of offshore assets following Q4’s downward revaluation on the back of the global equity wobble late last year. As a share of GDP the NILP fell 1.9 percentage points to 55.5 percent.

Image courtesy: ANZ Research

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals