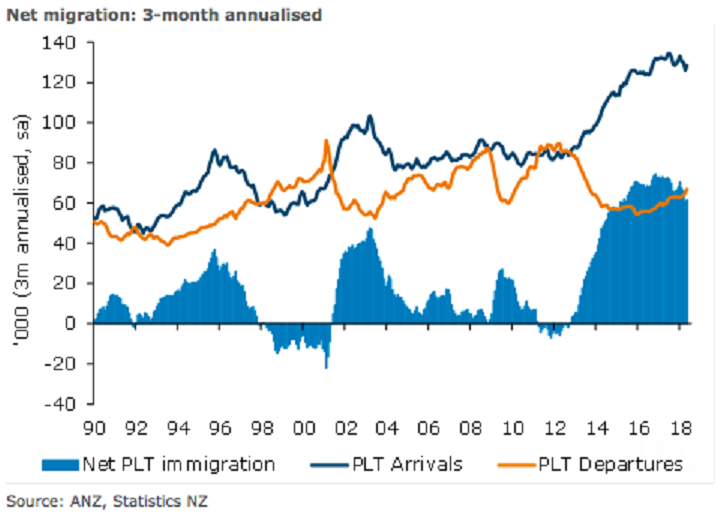

New Zealand’s monthly net migrant inflows continued to trend downwards, but ticked up on last month as arrivals bounced while departures continued to lift. Short-term visitor arrivals lifted and continue to hold at elevated levels. Strong migration-led population growth has been a key driver of economic activity this cycle and with net migration well and truly past its peak, the impetus to GDP growth is shrinking, ANZ Research reported.

Permanent and long-term net migration monthly inflows lifted by 170 to 5,090 in May (on a seasonally adjusted basis), as arrivals partially rebounded their April dip and departures continued to rise. Despite the monthly rise, the cycle is continuing to trend down gradually. The annual net inflow is now sitting a little above 66,000, down from more than 67,000 in April and its peak of 72,400 in July last year.

Permanent and long-term arrivals rose by 270 to 10,780 (sa), remaining below the 12-month average of around 10,900. The monthly rise was driven entirely by a rebound in non-New Zealand and non-Australian citizen arrivals, with New Zealand and Australian citizen arrivals both slipping marginally. Arrivals on residency visas continued to trend lower (-15.7 percent y/y), with work visas providing an offset (up 4.7 percent y/y). Student visas were broadly flat on a year ago.

Monthly permanent and long-term departures rose 100 to 5,690 (sa), above their 12-month average of 5,300, owing to a higher New Zealand citizen departures. Australian citizen departures fell a touch while other citizen departures lifted a fraction.

Short-term visitor arrivals lifted 2.7 percent m/m (sa), and were up 5.2 percent y/y (sa), following a softer print last month. Overall, visitor arrivals continue to point to a busy tourism sector, but the days-of-volume-driven growth are now in the rear view mirror.

"Likewise, given capacity constraints, it is difficult to foresee tourism taking another large leg up any time soon. But there is still room for expansion, particularly on the ‘value-added’ side," the report commented.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility