In the absence of an official analysis of the impact of the budget by gender the National Foundation for Australian Women has this morning published its own gender analysis of the budget, across multiple dimensions.

It finds the government has invested heavily in things that will mainly benefit men, including apprenticeships and traineeships (two-thirds of which are taken by males), the construction of physical infrastructure, and tax breaks for the purchase of assets that will primarily assist the male-dominated industries of mining and manufacturing.

The female-dominated care sector was largely overlooked, despite the Royal Commission into Aged Care and the Disability Royal Commission highlighting shortcomings in the current system.

Childcare workers were among the first to lose JobKeeper.

The extra funding injected into the aged care following tragic impacts of COVID was insufficient to bring the sector to a four star quality rating.

The experts believe the budget is a lost opportunity to maximise employment growth, to invest in the (social) infrastructure that will most boost the economy and to address the problems with female-dominated paid and unpaid work exposed by COVID-19.

Care boosts employment

Published with the National Foundation for Australian Women’s analysis is new modelling by the Victoria University Centre of Policy Studies on government investment in the care sector.

It examines what would happen if the government increased funding enough to boost the wages of personal and child care workers and to lift capacity to the point where it met unmet demand.

More than 900,000 Australians who provide unpaid care to the elderly, disabled, and children aged under five say they would like more hours in paid employment.

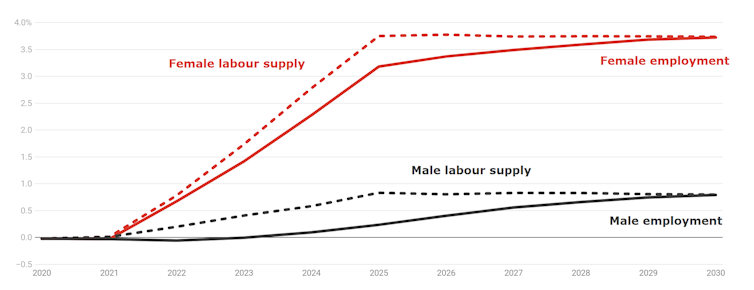

The modelling finds that the investment in the care economy needed to enable each of these unpaid carers to work an extra 10 hours a week in paid employment has a significant economic payoff, increasing labour supply by 2 per cent.

By 2030 the extra labour supply would be fully absorbed into employment. Annual GDP per person would be $1,270 higher, or more than $30 billion in aggregate.

Women’s paid employment would be 3.75 per cent greater than it would have been if no action had been taken. Men’s employment would be more than 0.75 per cent above the no-action base case.

Employment and labour supply impacts of modelled extra spending on care

Percentage deviation from base. Centre of Policy Studies, Victoria University

Percentage deviation from base. Centre of Policy Studies, Victoria University

The average incomes of both women and men would be higher, although women’s incomes would be higher by a greater margin.

A boost would almost pay for itself

The budgetary cost of the policy would be largely offset by increased economic growth which would underpin greater revenue collection from income taxes and the goods and services tax.

When fully running, the net cost to the budget would be less than one fifth of the direct cost.

Government investment in physical infrastructure helps in two ways – it provides construction jobs and a useful piece of infrastructure to support future economic activity.

Investment in care helps in three ways:

It stimulates jobs and better conditions in the care sector, a worthy outcome in itself.

It provides economic stimulus to all sectors by freeing people up to participate in the labour market, an impact that cannot be achieved by providing stimulus to other sectors, such as manufacturing, for example.

And it addresses female economic disadvantage by reducing the wage gap and changing the circumstances that often set limits on what women can achieve in their careers.

There’s a new budget around the corner

While the analysis shows the population on average would be better off with an expanded care sector, it says nothing about how to reform access to subsidised or government-funded care.

The system is complicated, as are the (dis)incentives to work resulting from the present tax and charging arrangements.

However charged for, extra spending on childcare, aged care and disability care would produce an bigger bang for the buck than most of the extra spending announced in the budget, as well as producing better outcomes for women.

There’s a budget update around the corner, in December, and a new budget due in May. If extra spending is needed, there’s an opportunity to do it in a way that would really help and almost pay for itself.

KiwiSaver shakeup: private asset investment has risks that could outweigh the rewards

KiwiSaver shakeup: private asset investment has risks that could outweigh the rewards  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Home ownership is slipping out of reach. It’s time to rethink our fear of ‘forever renting’

Home ownership is slipping out of reach. It’s time to rethink our fear of ‘forever renting’  Why the Middle East is being left behind by global climate finance plans

Why the Middle East is being left behind by global climate finance plans  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  U.S. Stock Futures Rise as Trump Takes Office, Corporate Earnings Awaited

U.S. Stock Futures Rise as Trump Takes Office, Corporate Earnings Awaited  Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth

Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation