The Norges Bank is expected to increase policy rates by 25bp at the next meeting on March 21, in line with previous clear guidance, according to the latest research report from DNB Markets.

Along with the executive board’s interest rate decision, the Monetary Policy Report 1/19 will also be released and a press conference following the announcement will be held at 10:30 am CET.

The Executive Board decided to keep the policy rate unchanged at 0.75 percent at its meeting held in December last year. The decision was unanimous and in line with consensus expectations but the Bank guided for another rate hike in March 2019.

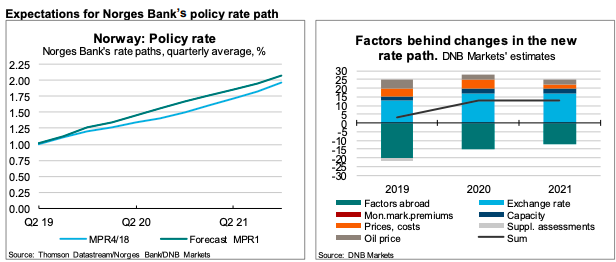

Data released since the December meeting broadly supported the central bank’s view on the economic trends. Furthermore, a weaker NOK, higher oil prices, and inflation above forecasts are all contributing factors that convince Norges Bank will raise rates faster than indicated in the December rat path.

A decline in the interest rate expectations abroad and an impaired outlook for the eurozone are likely to slow the rise in the rate path. The current path implies two 25bp rate hikes in 2019 with the latter at the December meeting, the report added.

Meanwhile, 3-month forward interest rates abroad have declined. From the week before Norges Bank’s December meeting, foreign FRAs have fallen by 7bp for 2019, 18bp for 2020, 27bp for 2021 and by 33bp for 2022.

"We believe the new rate path will imply the second rate hike to take place in September this year. Parallel to the meeting one year ago, we thus expect Norges Bank to state that "The Executive Board’s current assessment of the outlook and balance of risks suggests that the key policy rate will most likely be raised after summer 2019".", the report further commented.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic