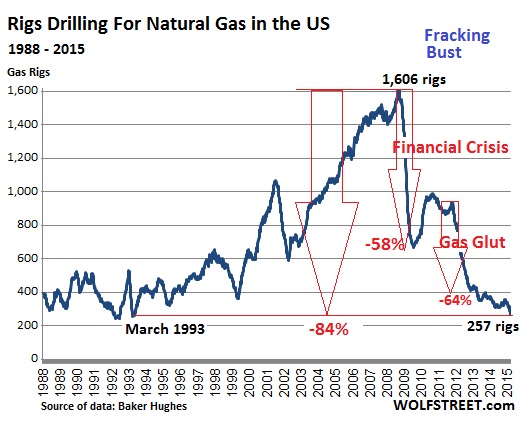

Number of active rigs in US has fallen by 46% from its peak from October 2014, in just less than six months. How much it really matters in terms of production and price? A case study from natural gas is presented. Chart courtesy Wolf Street.

Oil scenario -

- Oil price fell by 50% since June 2014, but production in US continue to surge. 4 week average production now stands close to 9.4 million barrels a day, only next to Russia and Saudi Arabia.

- Oil storage continues to run short, tanks are full close to 60% across US. Total stocks stands at 460 million barrels excluding the additional around 650 million barrels stored as strategic reserve.

Learnings from Natural gas -

- Fracking, the new technology to produce fuel actually started to boost production of Natural gas back in 2006-2008 period. At that time price of natural gas was hitting ceiling. Henry Hub was registering price of $13/mmbtu in June 2008.

- Investors poured in money to profit from natural gas boom. However then came 2008 financial crisis followed by Fracking boom that led to a supply glut. US became largest gas producer in the world. By 2012, price fell 85%, close to $1.92/mmbtu. Today in 2015, it is trading at $2.8/mmbtu, still at very low, compared to 2008.

- This resulting in a lot of money lost and bankruptcies. Latest victim was Quicksilver, its 2016 bond was trading just 2 cents on dollar at the time of bankruptcy. Private equity firm KKR lost around 3.5 billion as it bet to win from higher prices through Samson, a fuel producer.

- At the peak, there were 1600 rigs were operating in 2008, which as of now came down at just 257, lowest level since 1993 and down 84% from peak.

If history is a guide, then the fall in rig counts would matter less for crude oil prices and production and supply glut is here to stay for now. WTI is currently trading at $45.19/barrel, up 3% today.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary