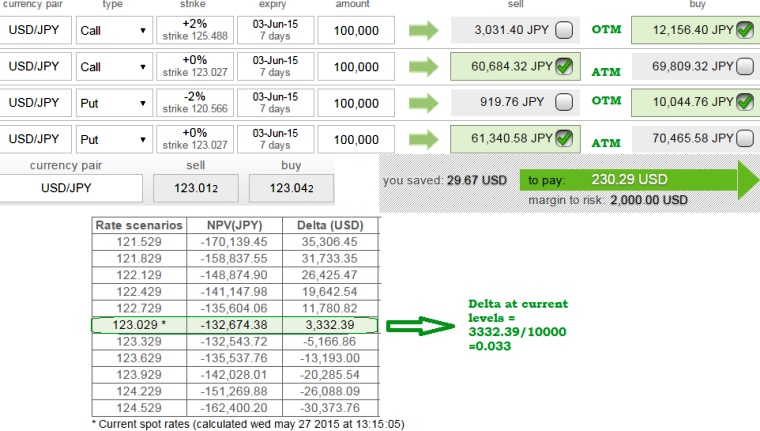

The rate of change option portfolio to a relative change in the spot market price of the underlying currency is shown as below:

For instance in our earlier post we had advocated iron butterfly, where ATM Call & Put were sold and simultaneously OTM Call & Put were bought on this pair.

Let's just revisit on this portfolio that was built earlier:

The OTM call has now at current a delta of 0.10 and the price of the underlying goes up by $0.0004, the value of the call could be expected to go up by approximately $0.0002.

While ATM call, delta approaches 0.50.

The OTM put has now at current levels a delta of 0.89, so any smaller change in the market price of the underlying will produce very little change in the value of the put.

If a put has a delta of 0.5 and the price of the underlying goes down by $0.0002, the value of the put could be expected to go up by approximately $0.0001.

As a whole, the strategy has been nearing delta at zero (accurately at 0.03) as shown in the figure.

Portfolio analysis on Iron butterfly USD/JPY

Wednesday, May 27, 2015 8:05 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?