We've been urging for safe zones preventing any currency threats of GBP ahead of general elections in UK. The equity funds saw a net retail outflow of GBP 963 mln in recent past. The largest net outflow ever recorded by the Investment Association, which releases monthly figures on the fund management sector.

A record GBP 1 bln was pulled out of fund that is invested in the UK stock market amid skeptism over the outcome of general election that is scheduled in next week. Investors moved their money into European equity funds, data released on Thursday showed.

We think investors are pulling money out of UK markets such as the FTSE 100 amid uncertainty over the political scene alone. Despite the fact that hot news engulfing around GBP's growth, we remain bullish on sterling. Unless any extremely adverse results from UK general election, it seems stronger over major hard currencies of world economies like $ and ¥.

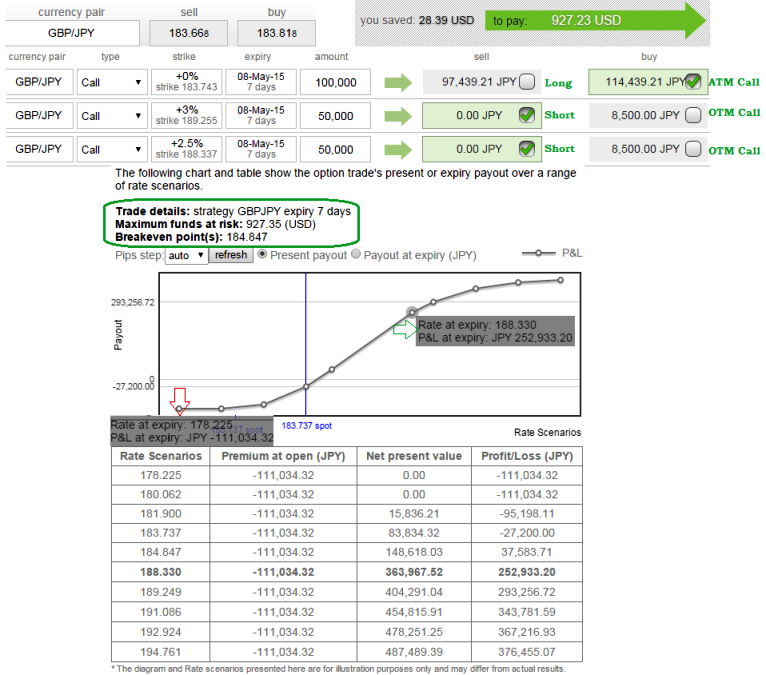

Derivatives Strategy: Call ratio spread

Overview: Sideways or slightly bullish

It has been closely monitored the GBP's fluctuations and its fundamentals, uptrend on GBPJPY is intact and but we also reiterate any necked positions are not advisable at this juncture as big event is underway. A few days ago Pounds trading against Indian rupee was strategized and this has resulted in a stiff hedge and a safe attractive profitability for traders.

GBPJPY is also moving in the same direction on sensitive political outcome. We therefore recommend "call ratio spread" as the pair is likely to remain either sideways or slightly bullish in our view. Buy a Call and sell more Calls at a higher strike price. Buying call spread in addition to selling more necked call options constitutes this hedging position. The portion should ideally be constructed in the ratio of 1:2 or 1:3 with short time for expiry is preferred.

Breakeven will be at: short strike price + difference in strike price + net credit

Pounds sturdy despite investors pull out 1 bln GBP ahead of UK general elections

Friday, May 1, 2015 6:38 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings