Eurostat, the EU’s statistics agency, released Eurozone inflation data for the month of June earlier today. Official figures show that inflation across the 19-country eurozone fell to its lowest level this year on easing energy prices. Data highlighted the European Central Bank's struggles to boost consumer prices since it first resorted to extraordinary measures by taking one of its key interest rates into negative territory in June 2014.

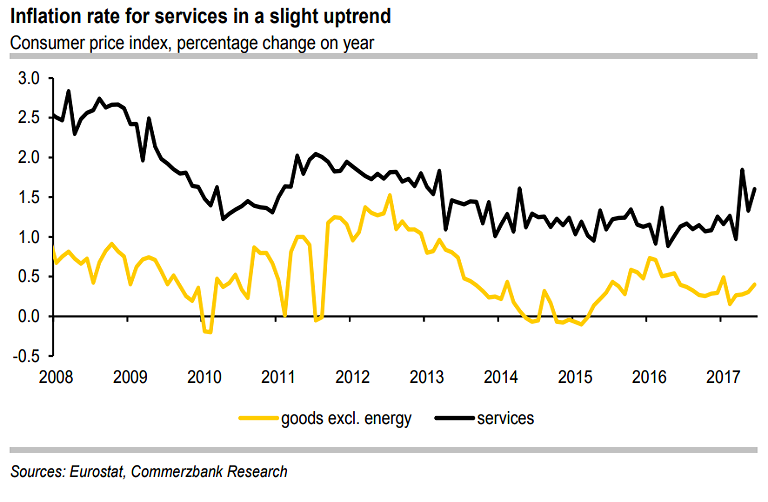

The eurozone’s annual rate of inflation fell for the second straight month in June to 1.3 percent in the year to June, down from 1.4 percent the month before. The core rate of inflation, which is the year-on-year rate of the consumer price index excluding energy, food, alcohol and tobacco – rose more than expected, by 0.2 percentage points to 1.1 percent. Inflation rate for services jumped from 1.3 percent to 1.6 percent.

The fall was largely attributable to a waning impact from higher energy prices, which were up only 1.9 percent from the year before against 4.5 percent in the previous month. The annual rate of inflation was slightly higher than anticipated, but the fall edged the annual rate further away from the ECB's target of just below 2 percent.

"We still assume that the core rate of inflation will only exceed 1% sustainably in 2018. This argues against an imminent ECB rate hike, especially with inflation expectations likely to remain low in view of the progressive decline of the headline rate of inflation to 1.3%," said Commerzbank in a report.

The ECB has recently upgraded its GDP projections as well as its risk assessment. But on the other side the central bank remains very cautious when it comes to inflation development. ECB president Mario Draghi has shown strong confidence on the monetary policy efficiency in his speech earlier this week.

Draghi said that the decline in interest rates has triggered a solid economic growth, deflationary pressures has disappeared and should gradually be replaced by reflationary forces. At the same time the speech also underlined the need to be persistent and prudent given, in particular, the real extent of labour market underutilization, suggesting that inflation should gradually pick up but it could take more time than currently forecast.

At 1100GMT, EUR/USD was trading at 1.1406, down 0.28 percent on the day. At the same time FxWirePro's Hourly Euro Strength Index stood neutral at -1.22995. For more details, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals