Well indeed with German bunds, What if the other way round.

Let's visualize a scenario where German bunds did not fetch this much yields and curve would have been narrowed. In which case the fund manager who would be operating his portfolios with systematic hedging strategies would have been paid more than half of the gain in return for a reduction in volatility of just one third including costs.

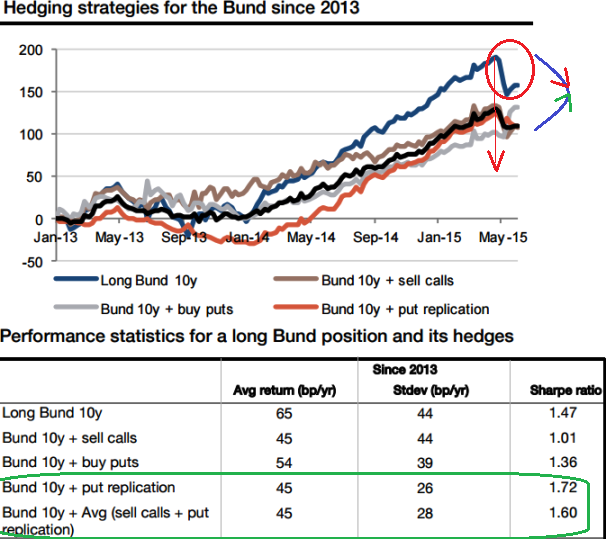

We've furnished different curves representing systematic hedging strategies and their performances in the above nutshell, this provides key performance statistics.

You can cautiously observe blue curve that represents 10y treasury declining from May has been a room for put replication & short call alternatives.

In terms of risk-adjusted performance, the Sharpe ratio of a long position in German Treasuries was 1.47, and the best that we could achieve with a systematic strategy was put replication at 1.72 while standard deviation of this avenue was the least 26. While SD was 28 on option combinations which would mean risk is higher with proportionate higher returns (see grey curve).

We tend to interpret these numbers are healthy because generally the greater the value of the Sharpe ratio, the more attractive the risk-adjusted return.

Put replication proved more effective means of hedging

Wednesday, June 10, 2015 7:21 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings