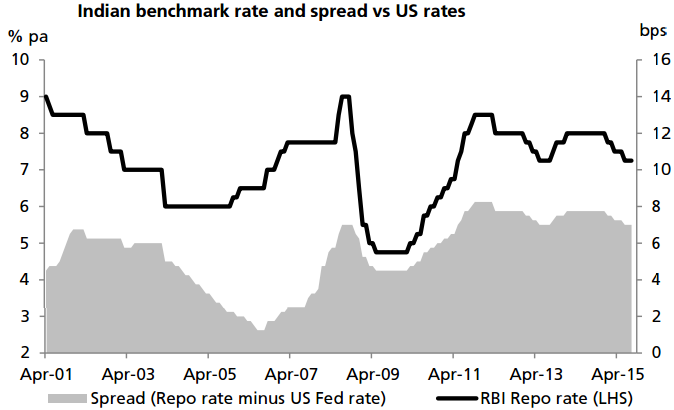

The Fed extended its on-hold stance in September, signalling the need for more data to justify rate normalization. Risks to global growth, primarily out of China, and heightened market volatility also received a mention. Against this background, expectations of an imminent US rate hike have dissipated, providing the RBI room to lower local rates. Moreover, when the Fed does raise rates, India's rates are unlikely to mirror them as in the past. Record high spreads and improved fundamentals will allow the RBI room to keep rates on hold.

Concurrently, the impact of a weak south-west monsoon proved to be more contained than earlier expected. Between June to mid-September, total rainfall is 16% below the long-term average, slightly worse than the 12% shortfall estimated by the Indian Meteorological department. A bout of catch-up rains in the past week is however expected to narrow the deficit. Pulses and vegetable prices are up modestly since June, but remain far from threatening levels.

Non-policy support was also stepped up this year. The government exercised fiscal restraint and raised minimum support prices for farm produce by less than 4% this year vs double-digits in the past. Global farm commodities are down 23% since 2014, as reflected in the UN FAO food index.

Short-term measures like expanding the essential commodities act, release stock of food grains, higher imports, discourage hoarding and black marketing activities etc. have also been undertaken. These factors have tempered the impact on food price inflation, with latter responsible for more than half of the 3% slowdown in headline CPI inflation since last year.

Receding risks of US rate hikes and catch-up in rains open the window for further RBI rate cuts

Tuesday, September 22, 2015 8:46 PM UTC

Editor's Picks

- Market Data

Most Popular

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target