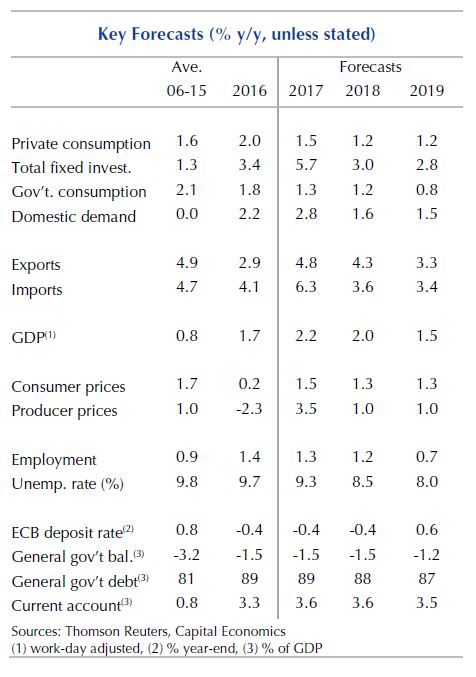

The eurozone's economic outlook appears bright despite renewed political uncertainty. The long period of healthy growth has yet to cause meaningful inflationary pressure. But the ECB will feel justified in easing its foot off the policy accelerator nonetheless. The latest data have given somewhat mixed signals about the economy’s performance in Q3. Surveys including the Composite PMI point to only a slight slowdown in quarterly growth from Q2’s pace of 0.7 percent. But hard data, including industrial production and retail sales, suggest that the recovery lost more momentum, Capital Economics reported.

The continued widening of the trade surplus implies that the euro’s strength has yet to hit exporters. Export growth might slow after a lag, but for now, surveys of export orders bode well, presumably reflecting the strength of global demand. And while a “hard Brexit” could ultimately damage euro-zone trade, the modest slowdown in UK demand so far has had little bearing. Investment prospects are strong because there is still a lot of lost ground to recover, business confidence is high and financing conditions are supportive.

Politics have come back to the fore, with the German election showing reduced support for mainstream parties and the push for Catalan independence creating uncertainty. But while increased euro-zone integration now seems even less likely to boost long-term growth potential, still-high levels of business and consumer confidence suggest that there will be little impact in the near term.

"We do not expect inflation to reach the ECB’s near-2 percent target over the next few years. But a desire to prevent excessive risk-taking and to encourage structural reforms will lead the ECB to reduce its policy support regardless. We expect it to taper its asset purchases to zero by September next year and to raise interest rates to 1 percent by the end of 2019. That may lead growth to slow a little, from about 2 percent in 2018 to 1.5 percent or so in 2019," the report said.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal