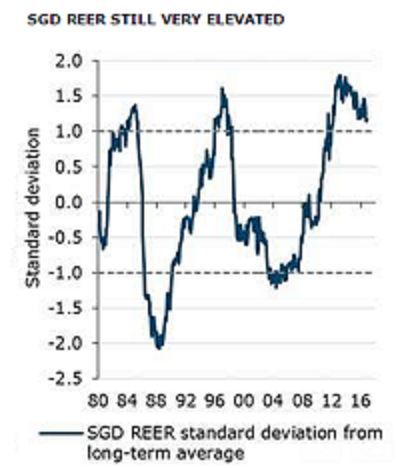

The SGD real effective exchange rate (REER) is still well above its long-term average. Given the state of the business cycle, the REER is very elevated and has scope to correct lower. The Monetary Authority of Singapore (MAS) noted in their October monetary policy statement (MPS) that the policy band provides flexibility for the SGD NEER to accommodate the near-term weakness in inflation and growth.

At present, the SGD NEER is estimated at 0.4 percent below the midpoint of the policy band. As such, there is still scope for further SGD NEER weakness before it reaches the lower bound, which is likely to be 2 percent below the midpoint which gives an implied USD/SGD rate of 1.4400, ANZ reported.

"With today’s NODX numbers showing a sharp 12 percent y/y contraction and the external environment still challenging, we expect the SGD NEER to continue heading towards the lower bound," it commented.

Meanwhile, USD/SGD has been moving higher and in the past week, the strength of the US dollar has driven it to an intraday high of 1.4197.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election