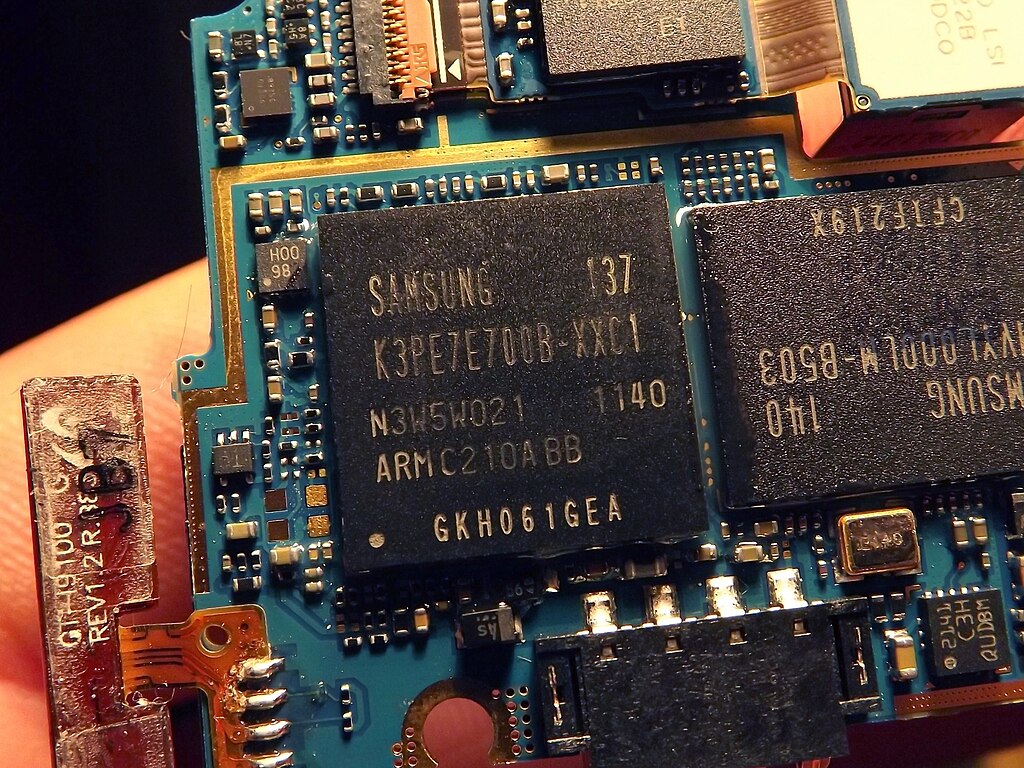

Samsung Electronics announced on Monday that it has signed a $16.5 billion contract to supply semiconductors to a leading global corporation, marking one of its largest chip manufacturing deals to date. The agreement, disclosed through a regulatory filing, was finalized on Saturday and covers contract chip manufacturing services. Specific details, including the client’s identity and contract terms, will remain confidential until the end of 2033.

The deal underscores Samsung’s strong presence in the global foundry market, where it competes closely with Taiwan Semiconductor Manufacturing Company (TSMC). Samsung is the world’s second-largest contract chip manufacturer and the largest memory chipmaker, playing a pivotal role in supplying advanced semiconductors for sectors ranging from consumer electronics to artificial intelligence.

Following the announcement, Samsung Electronics’ shares rose 3.5% in early trading on Monday, reflecting investor optimism about the company’s growth in high-value semiconductor production. The contract is expected to bolster Samsung’s foundry business at a time when demand for advanced chips, including those used in AI and data centers, continues to surge worldwide.

Industry analysts view the deal as a strategic win for Samsung, potentially enhancing its competitive positioning against TSMC as tech companies race to secure cutting-edge chip supplies. The long-term nature of the contract also signals strong confidence in Samsung’s manufacturing capabilities and its ability to meet increasing global semiconductor demand.

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains