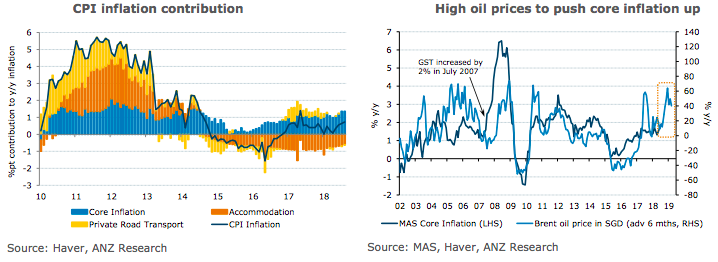

Singapore’s core inflation is expected to rise past 2 percent into the end of the year, and over the first half of next year, which is why the Monetary Authority of Singapore (MAS) is seen to tighten policy at their upcoming monetary policy meeting in October, according to the latest report from ANZ Research.

Today’s Singapore CPI data for August did not contain much surprise. CPI-All Items inflation rose to 0.7 percent y/y from 0.6 percent y/y the previous month, which was in line with market expectations. The MAS Core Inflation was unchanged at 1.9 percent y/y, below market expectations.

The improvement in the labour market should see a further pick-up in wages, which will feed through into inflation. High oil prices will also result in higher utilities and public transport costs as a direct effect, with some indirect flow-through as well, mainly into next year.

"We estimate that the 1.7 percent m/m decline in the communication index shaved around 0.1ppts from headline inflation. The drop in food prices is likely temporary, and should recover given the rise in global food prices," the report commented.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed