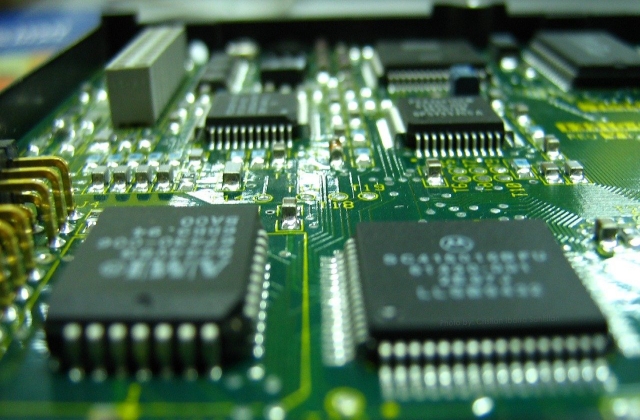

Sony Group Corp. and Taiwan Semiconductor Manufacturing Co. are cooperating to build a new chip plant in Japan. The Japanese multinational company headquartered in Tokyo is contributing to the project by agreeing to invest around $500 million.

Taiwan’s TSMC is currently building a semiconductor facility in the country and this move has been welcomed by the local government so it is getting a lot of support. As per Reuters, it was posted on the regulatory filing that Sony Group’s subsidiary, the Sony Semiconductor Solutions Corporation, is the one investing in TSMC’s chip plant and its contribution is said to be equivalent to less than 20% of the new project’s total value.

Sony Group and TSMC’s collaboration to construct a $7 billion chip factory is part of their efforts in helping ease the chip shortage and strained global supply chain for the valuable semiconductors.

“The digital transformation of more and more aspects of human lives is creating incredible opportunities for our customers, and they rely on our specialty processes that bridge digital life and real life,” TSMC’s chief executive officer, Dr. CC Wei, said in a press release that was posted by Sony on Nov. 9. “We are pleased to have the support of a leading player and our long-time customer, Sony, to supply the market with an all-new fab in Japan, and also are excited at the opportunity to bring more Japanese talent into TSMC’s global family.”

Sony Semiconductor Solutions Corporation’s president and CEO, Terushi Shimizu, also said that while the chip shortage may last longer than expected, they are hoping that the team up with Taiwan’s TSMC will greatly contribute to securing a stable supply of logic wafers not only for Sony but for the entire industry. He went on to say that its new partnership with the Taiwanese chipmaker is very meaningful to Sony Group.

Meanwhile, the construction of the chip factory is ongoing and the production of semiconductors may begin in the latter part of 2024. Thus, the companies may not be able to immediately help in addressing the chip shortage that is affecting the tech and auto industries.

OpenAI Secures $110 Billion Funding Round at $840 Billion Valuation Ahead of IPO

OpenAI Secures $110 Billion Funding Round at $840 Billion Valuation Ahead of IPO  U.S. Stocks Close Lower as Hot PPI Data, Nvidia Slide Weigh on Wall Street

U.S. Stocks Close Lower as Hot PPI Data, Nvidia Slide Weigh on Wall Street  Asian Currencies Slide as US-Israel Strikes on Iran Trigger Oil Surge and Risk-Off Rally

Asian Currencies Slide as US-Israel Strikes on Iran Trigger Oil Surge and Risk-Off Rally  Gold Prices Steady in Asia, Set for Strong February Gains on Safe-Haven Demand

Gold Prices Steady in Asia, Set for Strong February Gains on Safe-Haven Demand  Global Markets React as Dollar Surges, Swiss Franc Rallies After U.S.-Israel Strike on Iran

Global Markets React as Dollar Surges, Swiss Franc Rallies After U.S.-Israel Strike on Iran  PBOC Scraps Forex Risk Reserve as Yuan Rally Pressures Chinese Exporters

PBOC Scraps Forex Risk Reserve as Yuan Rally Pressures Chinese Exporters  Australia Housing Market Hits Record High Despite RBA Rate Hike

Australia Housing Market Hits Record High Despite RBA Rate Hike  Tokyo Core Inflation Slows Below 2%, Complicating BOJ Rate Hike Outlook

Tokyo Core Inflation Slows Below 2%, Complicating BOJ Rate Hike Outlook  Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding

Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding  Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets

Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets  Australian Job Advertisements Hit 16-Month High as Labour Market Stays Resilient

Australian Job Advertisements Hit 16-Month High as Labour Market Stays Resilient  Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  Boeing Secures $166.8 Million U.S. Navy Contract for P-8A Engineering and Software Support

Boeing Secures $166.8 Million U.S. Navy Contract for P-8A Engineering and Software Support  Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal

Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal  Oil Prices Surge 13% as U.S.-Israel Strikes on Iran Spark Supply Fears

Oil Prices Surge 13% as U.S.-Israel Strikes on Iran Spark Supply Fears  Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline

Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline