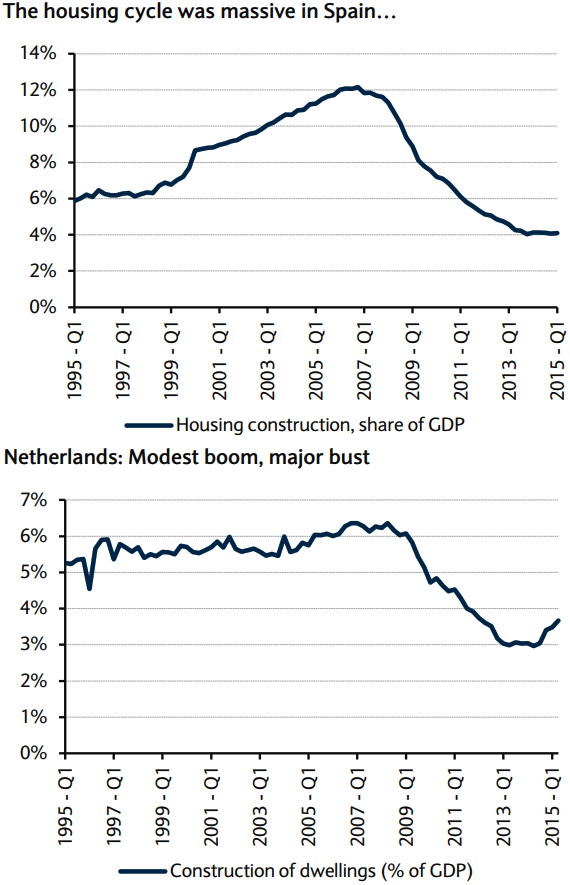

The most extreme housing booms and busts occurred in Spain and Ireland. In Spain, home construction peaked at 12% of GDP. Housing construction then fell (as percent of GDP) for 6 years in Spain, reaching historically abnormally low rates of 4% of GDP (Spain).

In contrast, some smaller countries experienced substantially more disruptive housing cycles, and these fall into at least two patterns. The Netherlands is interesting: although its construction boom was mild, it suffered a very disruptive bust. From its 2008 peak, housing construction fell for five full years, finally bottoming at 3% of GDP, roughly 2.5pp below the pre-boom norm.

This crash in home construction had more to do with a mortgage and household-debt problem than with an exaggerated episode of over-building. That said, it is consistent with evidence from other episodes that downdrafts in home construction typically last for years and the cyclical bottom is often well below historically normal rates of residential investment.

But the Spanish and Irish experiences are useful cautionary tales because they highlight just how massively the housing sector may contract after a period of overbuilding, in part because of financial pressures associated with the unwinding of the investment boom itself.

Spanish real estate failing to contribute its share of GDP – no longer an alternative avenue of investment

Thursday, September 3, 2015 7:36 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate