Sweden's inflation eased more than expected to a five-month low in March. Sweden's inflation fell to 1.3 percent in March, missing expectations at 1.5 percent in a Reuters poll, data released by Statistics Sweden showed on Tuesday. March inflation was the lowest since October 2016, when the rate was 1.2 percent. On a monthly basis, consumer prices remained unchanged after rising 0.7 percent in February. Prices were expected to gain 0.2 percent.

Underlying inflation (CPIF), which excludes the effect of interest rate changes in mortgages, came in at 1.5 percent. CPIF also missed expectations at 1.6 percent. Month-on-month, the CPIF remained unchanged in March, while it was forecast to edge up 0.1 percent. In February, Sweden's underlying annual inflation hit the central bank's 2 percent target for the first time since December 2010. But the central bank remains skeptical about stability of inflation around 2 percent until late in 2018, and has said it does not plan to raise rates before the start of next year.

Speaking at the Swedish Trade Union Confederation last week, Henry Ohlsson, Riksbank’s deputy governor said Sweden should start planning for how to deal with the end of its quantitative easing programme. It was a notable shift of tone from the central bank’s recent dovishness in official statements.

That said, Ohlsson once again defended the Riksbank’s stimulus that “without the expansionary monetary policy, growth and employment would have been lower and unemployment would have been higher. He added that “utilisation in the Swedish economy has now passed normal levels and can be expected to rise even higher in the coming years”, and said “we see ahead of us that inflation will rise towards the target”.

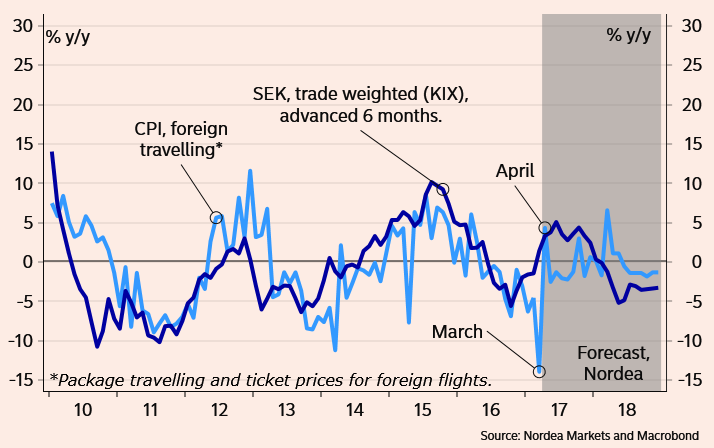

"We see no reason to change our long held view that CPIF-inflation will range between 1.5% and 2.0% until autumn. This will be good enough for the Riksbank, as long as inflation expectations are roughly in line with the inflation target and the SEK doesn’t strengthen too fast. We expect no more easing measures, while any tightening measures are still a long way off. We see a first rate hike in H2 2018," said Nordea Bank in a report.

EUR/SEK was down 0.45 percent on the day, trading at 9.5603 at around 1200 GMT. The pair has slipped below 100-DMA at 9.5695. Technical indicators have turned bearish adding scope for further downside. Break below 20-DMA support at9.5446 could see drag till 9.4835 (trendline support). FxWirePro's Hourly EUR Spot Index was at -65.4927 (Slightly bearish) at 1200 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran