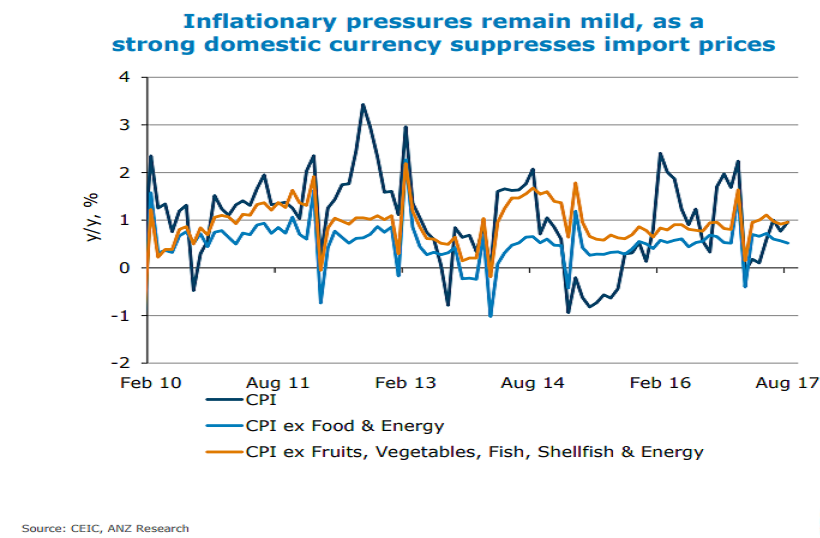

Taiwan’s consumer-price led inflation index (CPI) is expected to remain around 0.5 percent y/y till end-2017. An expected pay rise in civil servant and corporate salaries could further, provide a mild boost to CPI in 2018, ANZ Research reported.

Currently, the country’s CPI remains stubbornly low with a strong domestic currency suppressing import prices. August’s CPI rose by 0.96 percent y/y. CPI has risen by an average of just 0.5 percent since February 2017. With growth picking up only gradually, inflation is expected to remain benign in Q4 2017.

In the absence of a strong labor market recovery, wage growth is also unlikely to provide much impetus. The CBC kept the policy rate unchanged at 1.375 percent at its September meeting. It has been more than a year (June 2016) since the central bank made a cut.

"The decision is consistent with our view that the policymakers have switched to a wait-and-see mode and will only act if there is a massive change in the global financial situation. We expect the CBC to stay on hold over the next 12 months," the report said.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient