Exports in Taiwan unexpectedly rose during the month of October, following a recovery in the demand for the otherwise weak and dwindling electronics sector.

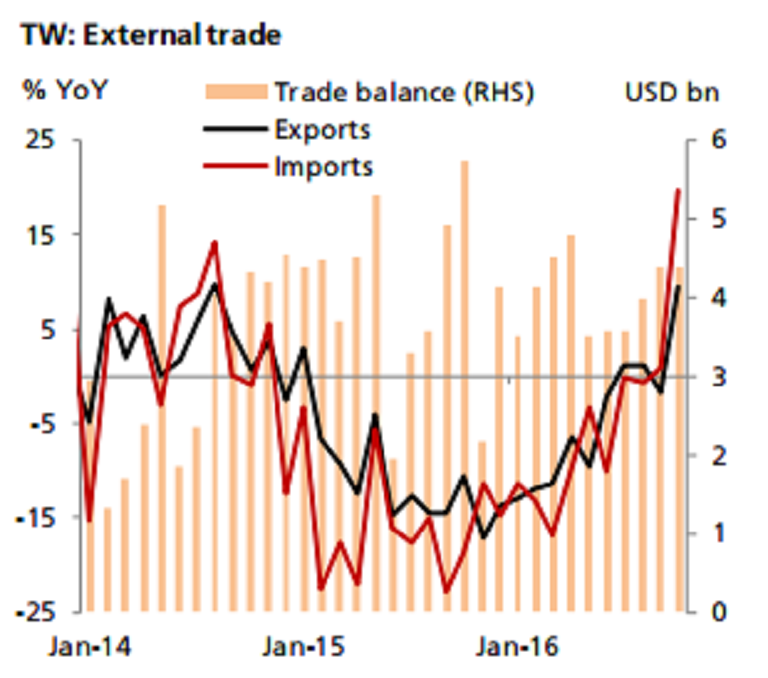

The external trade data for October was a pleasant surprise. Exports jumped 9.4 percent y/y, a sharp turnaround compared to -1.8 percent in the prior month. Imports growth also quickened to 19.5 percent from 0.7 percent.

Combining data in the past two months to strip out the impact of typhoons (which disrupted shipments in Sep16), the conclusion remains clear that external trade is improving. Exports and imports grew an average of 3.8 percent and 10.1 percent respectively in Sep-Oct, also a notable rise compared to 1.0 percent and -0.5 percent in Jul-Aug.

In addition to exports of the semiconductor-related components (15.3 percent), other key segments of electronics, like information and communication products (18.2 percent) and precision instruments (10.2 percent), also exhibited a strong rise in October. Meanwhile, capital goods imports surged as much as 47.6 percent in October, suggesting that electronics producers have started to not only restock inventories but also expand fixed investment.

While positive data should support the TWD and put upward pressure on domestic bond yields, external events would have a dominant impact this week. The upcoming US election results, dollar’s movement and development in global risk appetite should be watched closely.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination