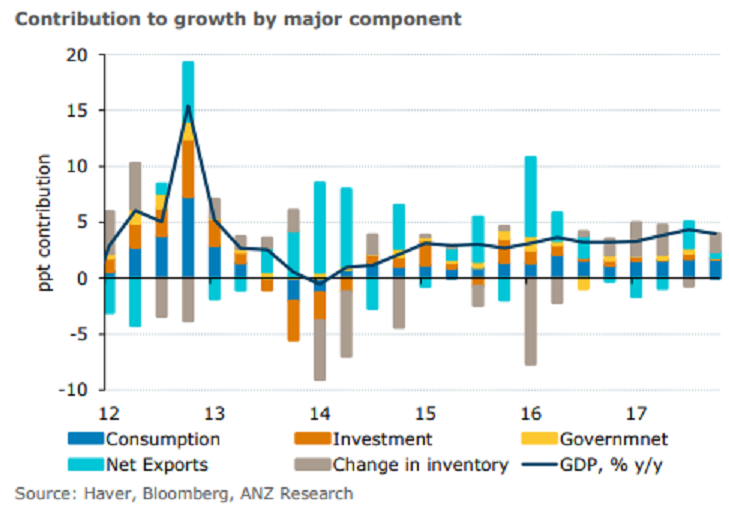

Thailand’s full-year gross domestic product (GDP) for 2018 is expected to come in at 3.7 percent y/y, with investment activity picking up only gradually during the year. Further, government infrastructure spending is expected to eventually start crowding in private investment, albeit in a gradual manner, according to a recent report from ANZ Research.

Thailand’s Q4 GDP increased by 0.5 percent q/q in seasonally adjusted terms, translating into an annual growth of 4.0 percent y/y. For full-year 2017, growth came in at 3.9 percent. Notwithstanding the full year growth number, there is scope for improvement in the breadth of growth. Growth remains predominantly supported by exports with private investment unable to gain traction through the year.

In Q4 2017, both private and public consumption also disappointed on a sequential basis, although this is likely to have been a one-off development. Until growth gains further breadth, the Bank of Thailand (BoT) is unlikely to start normalizing monetary policy.

The moderation in q/q growth was mainly on account of weakness in private and public consumption. The two components declined 1.4 percent q/q and 3.0 percent q/q respectively, even though the y/y growth for both was positive due to a favorable base. The contraction in these two components is likely to have been temporary.

"With this backdrop, the risk of a sustained increase in inflation remains low. While the BoT expects headline CPI to move into the target range of 1-4 percent in Q2, we believe it will settle close to the lower bound of this target range," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination