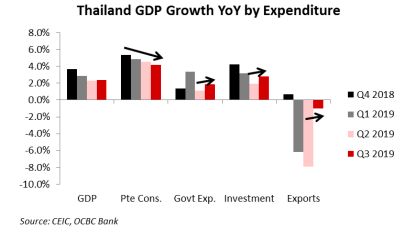

Thailand’s full-year 2019 growth has been downgraded to 2.7 percent by OCBC Treasury Research, a shade lower than the previous estimate of 2.8 percent, while the 2020 GDP growth rate remained unchanged at 2.9 percent.

The trickle-down effects of the THB316 billion programme in August are likely to continue working its way through the economy and should provide a boost to private consumption in Q4. Thailand’s Q3 GDP rose 2.4 percent y/y, coming in below expectations of 2.7 percent.

Government expenditure grew 1.8 percent y/y (OCBC est: 1.3 percent) while investments expanded 2.8 percent y/y (OCBC est: 2.9 percent), posting higher growth rates compared to Q2.

Private consumption, however, slid to 4.2 percent y/y in Q3, marking the fourth consecutive quarter of falling growth in a segment that comprises about 50 percent of total GDP in Thailand. Exports remained in contraction, as largely expected, but the pace of slowdown has declined.

The THB316 billion stimulus unveiled in August probably contributed to the better-than-expected government expenditure and investment segments. As it appears, it will still require more time for the effects of that stimulus to filter into household spending.

Q4’s private consumption growth would have to boast a number higher than Q3’s 4.2 percent to prove that the stimulus is effective and that the Thai economy has bottomed out, after a year of monetary easing and expansionary fiscal policies, the report added.

"Together with the rebound in investments and the stabilisation in exports, we think this provides a base for Thailand’s economy to find its footing going into 2020," OCBC Treasury Research further commented in the report.

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target