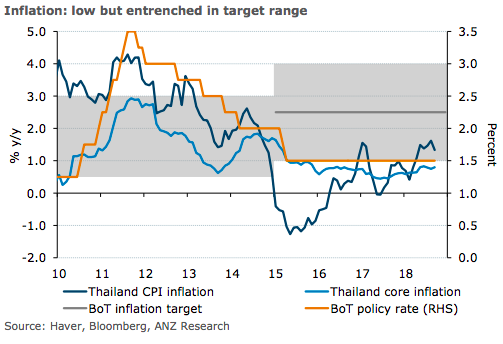

Thailand’s CPI inflation for September at 1.33 percent y/y (0.29 percent m/m) was higher than the forecast of 1.21 percenr y/y. With this print, headline inflation has now been in the Bank of Thailand’s (BoT) target range for a sixth consecutive month.

Core inflation at 0.80 percent y/y was however, and to some extent, suggests that demand pull price pressures are finally starting to build up, even if moderately. On a m/m basis, several key components of the non-food CPI basket increased at a faster pace than in August.

Key amongst these were housing (0.06 percent m/m), transportation (0.72 percent m/m) and recreation and education (0.03 percent m/m). Price increases in these categories quickened the sequential increase in Core CPI to 0.14 percent m/m from 0.01 percent m/m previously.

Food prices however, increased at a slower pace of 0.28 percent m/m compared with 0.51 percent m/m previously and had a dampening effect on headline inflation.

"Combined with the fact that headline CPI has now been in the BoT’s target range of 1-4 percent for six consecutive months, the case for policy normalisation is strong. We continue to expect the BoT to hike its policy rate by 25bps to 1.75 percent in November," ANZ Research commented in its latest report.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions