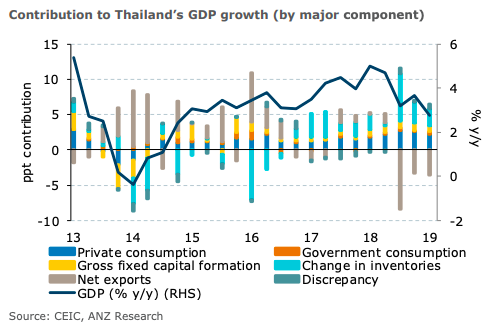

Thailand’s GDP expanded by 2.8 percent y/y in Q1, the weakest performance in four years. The decline in exports was a key drag, but private consumption and investment growth also slowed. Looking ahead, the economy faces multiple pressure points, ranging from weak external demand to domestic political uncertainty, according to the latest report from ANZ Research.

The breakdown showed a sharp decline in exports, while imports dipped slightly, resulting in net exports being a major drag on growth. Investment and private consumption growth also slowed, which more than offset the pick-up in government spending.

Notably, headline growth would have been weaker were it not for a continued build-up in Inventories. By sector, the manufacturing sector saw the sharpest slowdown, with growth at 0.6 percent y/y in Q1, down from 3.5 percent in Q4.

In sequential terms, the sector contracted by 1.9 percent q/q, the first decline since Q2 2015. Looking ahead, the economy continues to face pressure on multiple fronts, including a weak global trade environment, an inventory overhang, sluggish tourist arrivals, unfavourable weather, high household debt and political uncertainty.

Renewed US-China trade tensions are an additional threat and further clouds the export outlook.

"Our full-year growth forecast for 2019 is 3.2 percent, which pencils in a sub-3 percent growth in H1 and a pick-up in H2, helped by more favourable base effects and is premised on government formation taking place without material delays and a pick-up in infrastructure spending. The National Economic and Social Development Council (NESDC) is forecasting growth of 3.3-3.8 percent in 2019, down from an earlier projection of 3.5-4.5 percent," the report further commented.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns