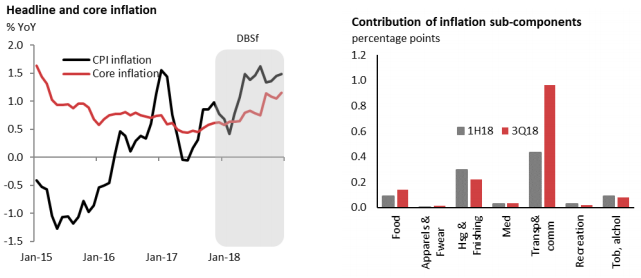

Thailand’s full-year inflation is expected to average 1.3 percent y/y, before rising to 1.6 percent next year on a higher core, according to the latest report from DBS Group Research. Inflation has shrugged off a slow start to the year, lifted by supply-side pressures, particularly high oil prices.

The Bank of Thailand had signaled its readiness to normalize rates, but a hike is not imminent given manageable inflation and a stable currency. Policy tightening expectations might resurface late-2018 and early next as the US continues to hike rates, and the spill-over impact weighs on EM. An upside surprise in Thai growth could also be another catalyst for the BoT to hike in 2019.

Better private consumption demand is being upheld by higher durables, which has helped offset the impact of a slower pick-up in non-durables and weaker service output. Private investment indicators are mixed, with the index in a holding pattern in recent months, whilst capital imports (value terms) moderate at the margin.

Cement sales and commercial pickups have, however, fared well. Rise in non-durables consumption remains modest but is likely to improve as farm incomes rise on higher agricultural output and better prices. Consumer confidence indices are holding up five-year highs.

"The BoT’s move to signal a shift towards a less accommodative policy does not, however, imply an imminent rate hike," the report added.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal