Written by James Carnell

Where it was once thought that mobile forex trading was too restrictive for traders to make efficient market decisions, the industry has taken over the App Store and shows no signs of slowing down as more complementary technologies become increasingly powerful.

According to analysis from Match-Trade Technologies, as much as 75% of all trades occur on mobile platforms today. This figure demonstrates the strength of app-based trading in forex.

This trend is supported by research suggesting that nearly 52% of global web page views are performed on mobile devices, with as much as 81% of users going online from mobile devices.

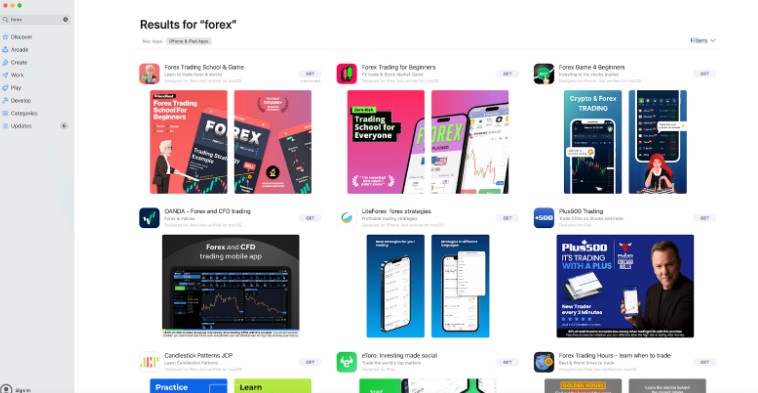

The necessity for the forex industry to complement this growing trend in mobile usage has led to an explosion in the volume of apps available on Apple's App Store and the improvement in technology to support mobile traders with different user experience (UX) expectations compared to their desktop-based counterparts.

A single search for "forex" on the App Store today returns 202 results, with many forex platforms ranking highly on Apple's financial downloads charts.

With this rapid expansion into a relatively new mobile market, forex platforms have faced new challenges in appealing to traders on different devices, requiring new technologies to support trading despite limited access to the vast screen spaces enjoyed by desktop traders.

Promoting Perpetual Access

While mobile forex platforms cannot replicate the extensive access enjoyed by traders with multiple desktop monitors, developers have sought to adapt their products to excel in areas where desktop applications fall short.

The key advantage of mobile forex platforms is their around-the-clock access to markets, which is not easily replicated on desktops. This means trades can be made on the go or immediately after major news breaks that could impact markets.

Although smartphone screen space may limit access to live visualizations, mobile forex platforms have countered this through innovative developments within their apps.

For example, MetaQuotes' MetaTrader 5, one of the largest forex players on the App Store, has introduced advanced mobile features such as professional-level technical analysis leveraging built-in indicators and analytical objects. These features enable traders to gain stronger insights, monitor trade histories, execute transactions, and perform essential analysis with ease.

Optimizing Emerging Technologies for Mobile

The growth of mobile technology has facilitated greater levels of automation in forex, allowing traders to create personalized strategies that suit their goals and manage them via mobile apps.

Automated strategies, like forex arbitrage software, are gaining popularity in the forex landscape. They help traders establish rules and parameters for executing trades automatically.

This automation advantage for mobile users eliminates the need for larger screen space to closely monitor markets and changing trends. Instead, traders can let trading bots perform the work while adopting a supervisory role. In the case of arbitrage forex trading software, this approach allows traders to profit from temporary market inefficiencies by adjusting goals and monitoring the program's performance through mobile apps.

However, it's worth noting that this method carries risks, and the rise of mobile automation in forex means that some traders may be negatively impacted by perpetual access to trading apps.

Around the Clock AI Insights

AI algorithms can also be used in conjunction with mobile forex platforms to analyze data more effectively, identifying emerging market trends to inform trading decisions.

Mobile traders, with easy access to social media networks, can utilize artificial intelligence social listening tools to monitor digital spaces for changes in sentiment towards global currencies and economies. They can then automatically act on the findings.

With leading globally-focused social networks just a few clicks away, mobile traders can better monitor the actions of their AI mechanisms, track progress, and make adjustments as needed.

In the coming years, as generative AI continues to mature and become more powerful, traders may prompt AI platforms like ChatGPT to conduct sentiment analysis before acting on insights, helping users achieve specific goals over predetermined timeframes.

Tomorrow's Innovations Will Strengthen Mobile

Mobile forex trading is evolving rapidly, and the future of the industry is poised to witness further digital transformation through blockchain technology.

Blockchain has the potential to fundamentally change how trading is conducted, with the prospect of decentralization throughout the market leading to lower fees and seamless cross-border transactions without middlemen.

With an estimated $7.5 trillion changing hands each day in global currency trading, the next generation of trading technology has significant expectations to fulfill. However, with mobile platforms facilitating increased connectivity for traders, it's likely that the future will see even more activity spread across forex markets. Mobile applications will continue to enhance efficiency and accuracy across various areas.

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks