While Draghi usually displays an impressive mastery of the press conference, he has had "communication mishaps" in the past. If he comes out too hawkish next week, ie, too dismissive of the risks, the euro exchange rate could undergo a knee-jerk leap, which would make waiting until 3 December quite taxing for the Euro area.

Without a quick response from the ECB, we believe the new configuration for world demand combined with tightened financial conditionscould cost the Euro area's GDP growth 0.2/0.3ppt, still leaving a decent pace (above potential) but with no acceleration relative to this year.

"The acceleration of our forecasts from 1.6% GDP growth in 2015 to 1.9% in 2016 was mainly driven by a pick-up in capex from 2.0% to 2.7% (Table 2). This was expected to be fuelled by re-emergence of the lending cycle with abundant liquidity, expectations of decent growth for a couple of years, and real rates at their lowest levels for a while", says Bank of America.

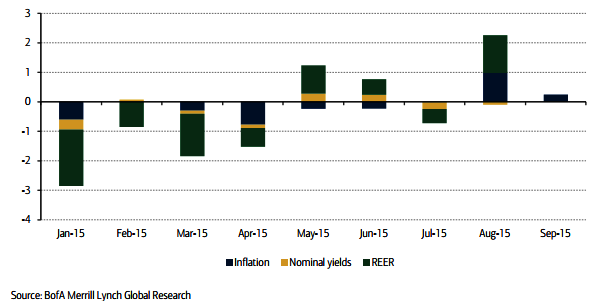

This would certainly at least be questioned if the ECB response was not fast and/or strong enough. And in contrast to May, the recent move has a lot to do with the evolution of real rates, which in turn have been driven by falling inflation expectations, together with the evolution of the currency.

This generalized tightening of monetary conditions was the main driver of our QE2 call for this year. If looked in particular at the long end of real rates, the important ones for the evolution of investment, since the lows in Q2 10Y real rates are up 30bp.

"If the ECB disappoints and real rates do not move much from where they are in the short run, that would cost the 20-30bp in terms of GDP for 2016 suggested above, since it would impact the evolution of investment in the next few quarters", added Bank of America.

Tighter conditions until December could harm Euro area growth

Wednesday, October 21, 2015 3:32 AM UTC

Editor's Picks

- Market Data

Most Popular

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook