Treasuries are down today, pushing yields higher as Peoples bank of China (PBoC) in a rare press conference tried to calm nerves assuring three consecutive days of devaluation is not part of nay larger or major devaluation and Chinese currency.

PBoC's move can be defined as official attempts to make Chinese currency more convertible. As of now, China's central bank heavily controls capital flows in and out of the country and manages Yuan with heavy intervention.

Stock markets have recovered most of its loss this week, reducing demand treasuries.

- S&P500, most stubborn of all indices, recovered from 2050 area yesterday to trade as high as 2097.

- China's Shanghai composite managed to close in positive after two consecutive drop, up 1.72% today.

- UK's FTSE 100 is up 0.8%, while German DAX is up 1.8% so far today.

Naturally with return of risk appetite, treasuries lost their shine, pushing yields higher.

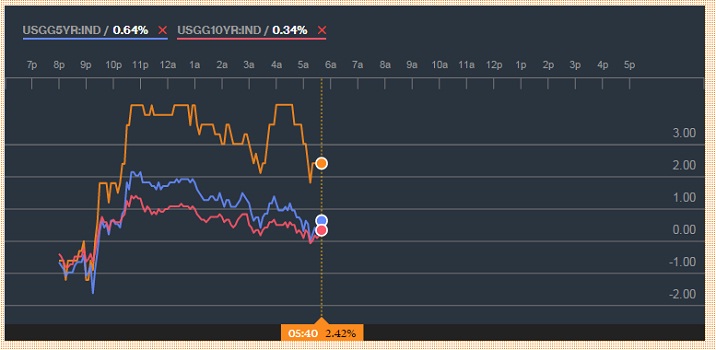

- 2 year treasury yields are up 2.42% as shown figure, trading at 0.68%

- Similarly, 5 year yield is up 0.64% and 10 year is up 0.34%.

Dollar has somewhat recovered from earlier loss this week over rising yields. FXCM US Dollar index is currently at 11991, up from yesterday's low around 11946.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate