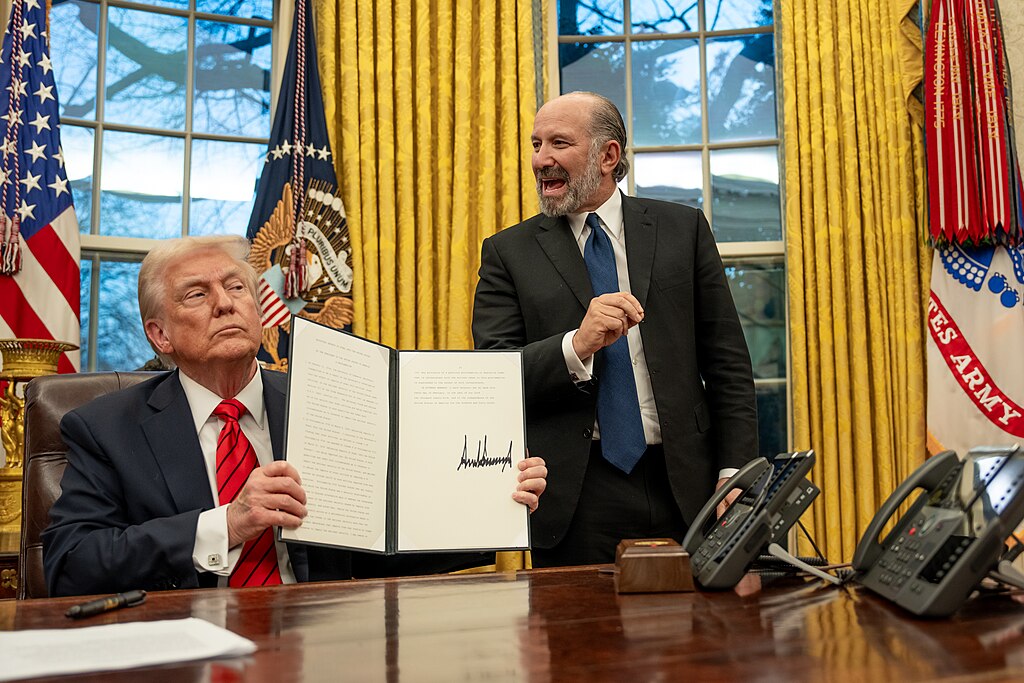

U.S. President Donald Trump confirmed on Sunday that several trade deals have been finalized, while additional countries will soon receive formal notices regarding increased U.S. tariffs. This announcement signals a major shift in U.S. trade policy, aimed at pressuring global partners to negotiate more favorable terms.

Speaking before departing New Jersey, Trump emphasized that the U.S. is actively finalizing the details of tariff rates and agreements. “Some deals are done,” he said. “Others will receive letters about new tariffs very soon.”

Commerce Secretary Howard Lutnick clarified that while Trump previously announced a 10% base tariff in April on most imports, the full implementation—initially scheduled for July 9—has now been extended. The revised timeline means the new tariffs will officially take effect on August 1, giving trading partners a brief window to respond or renegotiate.

The upcoming changes include tiered tariff rates, ranging from the 10% base rate to as high as 50% for certain nations. This structure is part of Trump’s broader strategy to reshape global trade dynamics and encourage domestic manufacturing.

While the White House has not disclosed which countries will be affected next, analysts expect targeted action against nations with significant trade surpluses with the U.S. The decision follows months of uncertainty as markets anticipated the administration’s next move after the 90-day delay announced in April.

This latest update introduces fresh volatility into global markets, as businesses brace for potential cost increases and supply chain disruptions. Investors and exporters alike are closely watching for further announcements, especially as the August 1 implementation date nears.

With tariff policies once again in motion, global trade relations face heightened tensions heading into the second half of 2025.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans

TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms  NATO to Discuss Strengthening Greenland Security Amid Arctic Tensions

NATO to Discuss Strengthening Greenland Security Amid Arctic Tensions  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions