U.S. President Donald Trump announced a finalized trade agreement with China, pending mutual approval from both him and Chinese President Xi Jinping. In a post on Truth Social, Trump stated, "OUR DEAL WITH CHINA IS DONE," emphasizing the "excellent" relationship between the two leaders.

The deal follows two days of high-level negotiations in London and builds upon a prior framework set in Geneva aimed at de-escalating retaliatory tariffs. As part of the agreement, the U.S. will gain access to China's rare earth minerals and magnets—resources critical for electronics and defense—while Chinese students will continue to have access to American universities.

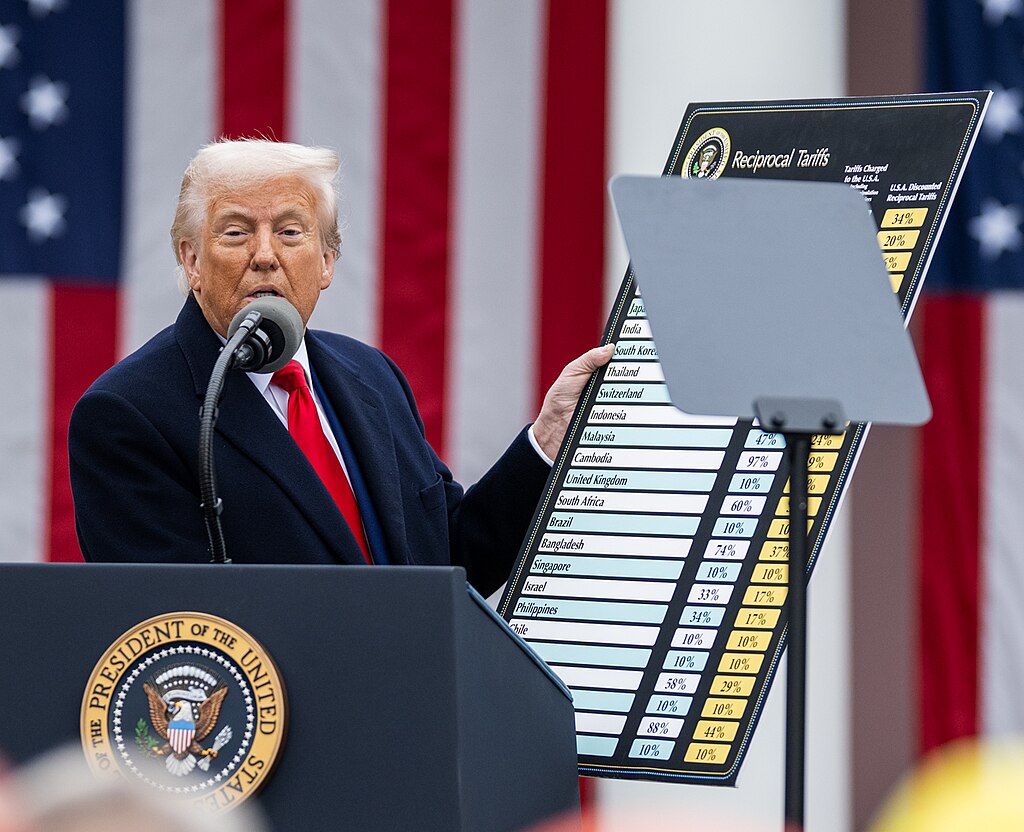

Trump revealed that the U.S. will impose a 55% tariff on Chinese imports, while China will maintain a 10% duty on American goods. This represents a formal shift from the previous tit-for-tat measures that had raised tariffs to unprecedented triple-digit levels on both sides.

U.S. Commerce Secretary Howard Lutnick praised the framework for adding "meat on the bones" to the Geneva discussions, which had faltered due to China’s restrictions on critical mineral exports. The U.S. had responded with new export controls targeting semiconductor design software, aircraft, and other advanced technologies.

The announcement brings cautious optimism to global markets, though concerns remain over Trump's unpredictable trade strategies and the long-term impact on global supply chains. Businesses hit by disrupted shipments and rising costs are watching closely for signs of regulatory stability. The deal signals a potential thaw in U.S.-China trade tensions, but its final impact hinges on formal ratification and consistent enforcement.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock