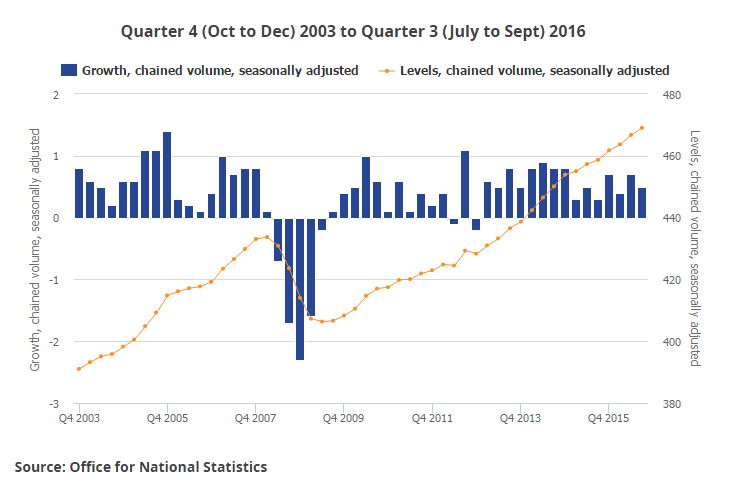

The second reading of UK Q3 GDP matched original estimates and came in to show a growth of 0.5 percent during third quarter of 2016. It was the fifteenth consecutive quarter of positive growth since Q1 2013. On an annualized basis, the growth rate also confirmed the preliminary reading of 2.3 percent, inline with forecast.

Q3 reading includes data for the whole period after the EU referendum and has been in line with recent trends suggesting limited effect so far from the referendum. A 0.7 percent rise in household spending highlighted the extent to which consumers appear to have remained largely unaffected by the Brexit vote.

“To say that the economy has been unscathed by the Brexit vote would be too complacent. For the moment, the data suggest that the economy has exhibited greater than anticipated resilience in the face of headwinds such as Brexit worries and rising prices. However, it seems likely that growth will slow further in coming months as these headwinds intensify.” said Chris Williamson, Chief Business Economist, IHS Markit.

Business investment was estimated to have increased by 0.9 percent in Q3 compared with the previous quarter, but was down 1.6 percent on the year. Following a 1 percent drop in the second quarter, exports were up 0.7 percent in the third quarter, while imports fell 1.5 percent following a 1.3 percent jump the previous quarter.

Out of the 4 main output industrial groupings within the GDP, only the services sector showed an increase in Q3. Service industries increased by 0.8 percent in Q3, unrevised from the previous estimate. It was the 15th consecutive quarter of positive growth and follows a 0.6 percent increase in Q2 2016.

Production output decreased by 0.5 percent in Q3 2016 compared with Q2 2016, revised down 0.1 percentage points from the flash estimate. Manufacturing which is the largest component of production, decreased by 0.9 percent.

Howard Archer, chief European and UK economist at IHS Markit, expects the UK economy to grow by 2.1 percent in 2016. “This assumes that the economy will expand by a respectable 0.4% quarter-on-quarter in the fourth quarter. The October survey evidence was decent, while retail sales surged during the month. In fact, October’s surge in retail sales suggests that there is a very real possibility that growth in the fourth quarter could again surprise on the upside.”

GBP/USD was largely muted on UK GDP, trading around 1.2450 at around 1140 GMT, while EUR/GBP was trading at 0.8505. FxWirePro's Hourly EUR Spot Index was at 4.70158 (Neutral), Hourly GBP Spot Index was at 8.38682 (Slightly bullish) and Hourly USD Spot Index was at -49.9578 (Neutral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination